Summary

- PNNT reports results later this week and this update was previously provided to subscribers of Premium Reports along with target prices, dividend coverage and risk profile rankings, credit issues, earnings/dividend projections, etc.

- On November 5, 2018, Matlin & Partners Acquisition Corporation (NASDAQ: MPAC, MPACU, MPACW), announced that shareholders have approved MPAC’s merger with U.S. Well Services, (“USWS”). PNNT’s loans will be refinanced and its equity position will be publicly traded.

- PNNT is a component in the ‘Recommended Higher Yield’ portfolio due to its current yield of 10.1%, higher quality management, stable dividend, and trading over 5% below its short-term target price.

- As predicted, PNNT has been actively repurchase shares including almost 1.1 million (1.5% of outstanding shares) from May 1, through June 30, at a 19.2% discount to its previous NAV.

- NAV per share increased by 1.0% (from $9.00 to $9.09) partially due to accretive share repurchases and net realized/unrealized gains of over $5.1 million.

- More importantly, the company continues to deliver net “realized” gains from exiting investments including $17.4 million during the recent quarter and a total of $43.0 million over the last three quarters.

- Continued accretive share repurchases should improve earnings/NII per share along with portfolio growth and use of leverage as well as monetizing (selling and reinvesting) its equity investments that could result in a dividend increase at some point.

- There were no investments on non-accrual as of June 30, 2018, and energy, oil & gas remains around 14% of the portfolio.

The following is a quick update that was previously provided to subscribers of Premium Reports along with target prices, dividend coverage and risk profile rankings, credit issues, earnings/dividend projections, quality of management, fee agreements, and my personal positions on all BDCs (including this one) please see Deep Dive Reports.

Dividend Coverage Update

PNNT has historically covered its dividends through the previously discussed reduced management fees, the ability to use higher leverage with SBA borrowings, and rotating the portfolio into higher earning assets from upcoming monetizations:

“So we feel good about the opportunity to deploy capital to live within the 80% leverage ratio at this point, utilize our enhanced platform, and continue to drive income that covers the dividends. As I said in my remarks, our recovering NII today covers our dividend, and that excludes the other income that we typically get between $0.01 and $0.03 per share per quarter, to enhance that recurring income. So we feel very good about the dividend coverage. Feel good about the economies of portfolio and we’re on the mission to monetize the equity investments and energy investments over time hopefully can provide upside.”

I am expecting continued share repurchases given that the stock is still trading at a 20%+ discount to its NAV per share and the company had over $107 million in cash. These purchases will be accretive to earnings/NII per share along with continued portfolio growth and use of leverage as well as monetizing (selling and reinvesting) its equity investments that could result in a dividend increase at some point:

“We are pleased with the progress we are making on several fronts. Adding people to our platform has resulted in a significantly enhanced deal flow which puts us in a position to be both more active and selective. Our activity level in the quarter ended June 30, 2018, along with the increase in LIBOR, has resulted in a more senior secured portfolio with a current run rate net investment income which covers our dividend,” said Arthur H. Penn, Chairman and CEO. “We believe that with a generally stable underlying portfolio we should be able to provide investors with an attractive dividend stream along with potential upside as our equity investments are monetized.”

On September 07, 2018, PNNT declared a distribution of $0.18 per share, paid on October 2, 2018 and the company has approximately $0.26 per share of taxable spillover income and gains and I believe that the current dividend is sustainable after taking into account the new fee structure as shown in the Leverage Analysis.

“As of September 30, we had taxable spillover of $0.26 per share, which provides further dividend cushion. With a generally stable underlying portfolio and substantial spillover, we believe that PNNT stock should be able to provide investors with an attractive dividend stream, along with potential upside as our equity investments mature.”

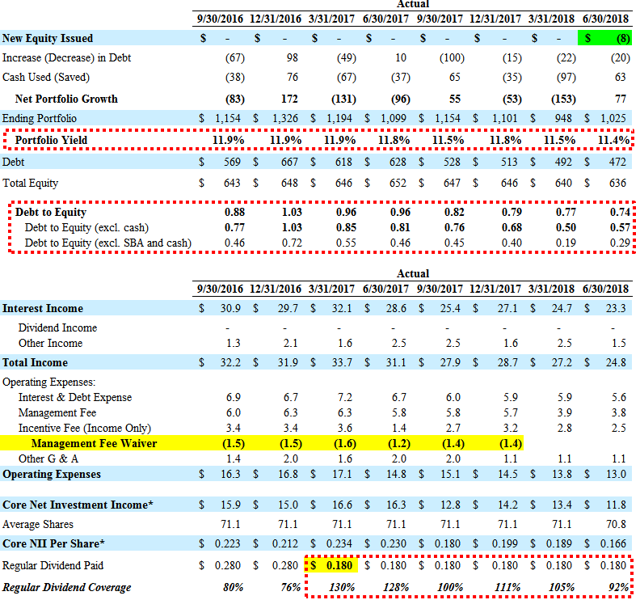

For the quarter ended June 30, 2018, PNNT reported just above my base case projections and was not expected to cover its dividend due to the previous quarter with “larger-than-expected decline in portfolio investments driving a historical low regulatory debt-to-equity of 0.46”. However, the company covered 92% of its dividend during the recent quarter and has covered by an average of 111% over the last 6 quarters. As predicted, there was another decline in the overall portfolio yield from 11.5% to 11.4% as the company invests in safer assets at lower yields including the most recent investments at an average yield of 10.5%.

“As we move up the capital stack, our overall yield in the portfolio has come down a bit. That said, we’re starting to get some offset from LIBOR. And then again rotating our equity and energy investments into cash paying debt securities over time should be a positive. And so, look, we think there is upside you saw this quarter on our run rate, our recurring NII, before our other income is covering our dividend now. And we think it has a reasonable shot continue to grow as LIBOR, it goes up over time, as we rotate those energy in equity investments, and we should provide a very solid comfortable hopefully cushion to our dividend stream.”

I have assumed continued declines in its portfolio yield as shown in the projections and going as low as 10.2% in the Leverage Analysis as management is expecting “into the 10% to 11% zone”:

“Over time given our strategy if that’s going to go down into the 10% to 11% zone as we continue to move up capital structure and derisk the portfolio although we are starting to get some benefit from LIBOR which is nice, so that will mitigate some of that.”

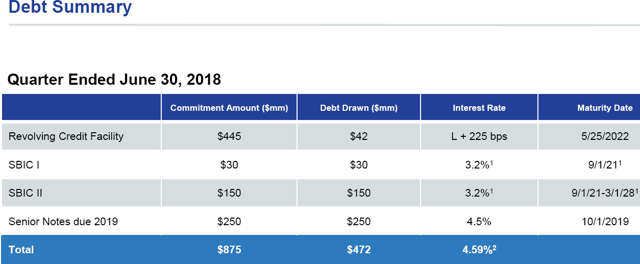

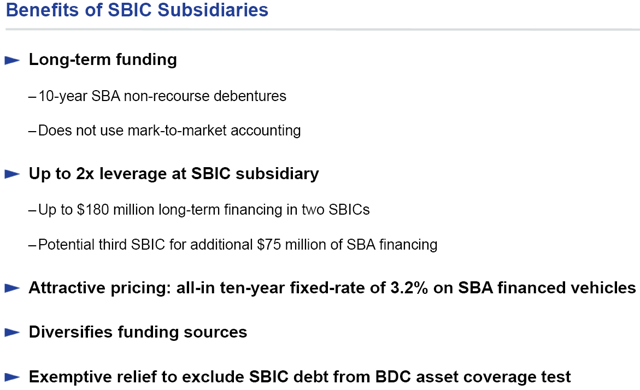

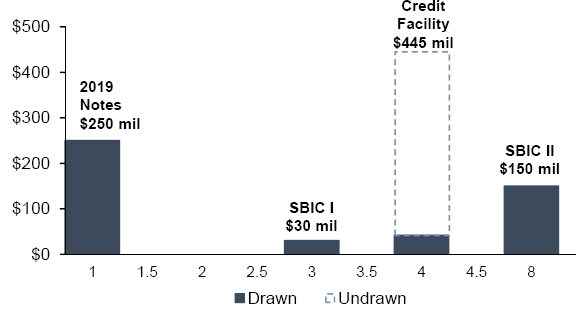

The company has significant borrowing capacity due to its SBA leverage at 10-year fixed rates (current average of 3.2%) that are excluded from typical BDC leverage ratios. Management was recently asked increasing leverage through reducing its required asset coverage ratio and mentioned that they would like “to maintain our investment-grade ratings”.

As discussed in previous reports, I am expecting minimal portfolio growth as the company is keeping a conservative leverage policy of GAAP leverage (includes SBA debentures) near 0.80 until it can rotate the portfolio into safer assets. However, as mentioned earlier, the company has over $107 million in cash for debt-to-equity ratio of 0.57 after excluding cash, implying that there is available capital for share repurchases and portfolio growth over the coming quarters.

“As you all know, the Small Business Credit Availability Act was signed into law on late March. At the current time, we’re not going to increase leverage at PNNT. Our intention is to maintain our investment-grade ratings or bonds through their maturity in October 2019. As we get closer to October 2019, we will assess the investment at financing landscape and evaluate our strategy with the goal of maximize long-term value for our stakeholders. We remain comfortable with our target regulatory debt-to-equity ratio of 0.6 times to 0.8 times. We’re currently at about 0.5 times regulatory debt-to-equity. On an overall basis, we are targeting GAAP leverage of 0.8 times.”

Management is focused on maintaining its net interest margin and dividend coverage, even as its portfolio yield continues to decline, through selling most of its equity positions and rotating into income producing investments and reduced borrowing rates by redeeming its 6.25% Baby Bond.

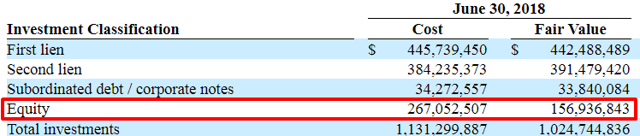

“We look forward to continuing to monetize the equity portion of our portfolio. Over time, we’re targeting equity being between 5% to 10% of our overall portfolio. As of June 30, it was 16% of the portfolio.”

The company has applied for its third SBIC license and subsequent to quarter-end, the company previously repaid $15 million of SBA debentures:

“We’re gradually paying down SBIC I. We’re down to $30 million in SBIC I. We’ll continue to gradually pay that off. And we’re into the SBA with an application for SBIC III. And we’re hopeful that at some point we can move forward on that.”

Risk Profile Update:

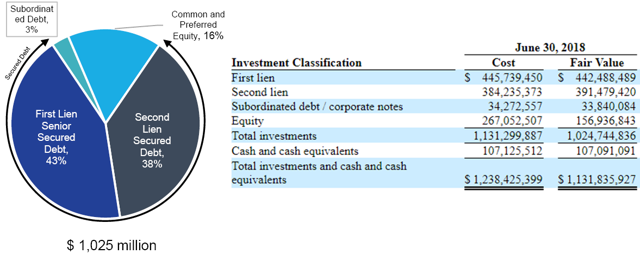

As mentioned earlier, management is in the process of “de-risking” the portfolio which is currently invested 43% in senior secured first-lien debt, 38% in second-lien secured debt, 3% in subordinated debt and 16% in preferred and common equity. Management has its “three-point plan” that includes rotating the portfolio into higher credit quality first and second-lien lower yielding debt that will likely result in continued lower portfolio yields:

“We are focused on lower risk, primarily secured investments, thereby reducing the volatility on our earnings stream. Investments secured by either a first or second lien are about 81% of the portfolio. We are also focused on reducing risk from the standpoint of diversification. So number two, as our portfolio rotates, we intend to have a more diversified portfolio with generally modest bite sizes, relative to our overall capital. And number three, we look forward to continuing to monetize the equity portion of our portfolio. Over time, we’re targeting equity being between 5% to 10% of our overall portfolio. As of June 30, it was 16% of the portfolio. Our portfolio is constructed to withstand market and economic volatility. In general, our overall portfolio is performing well. We have a cash interest coverage ratio of 2.6 times and a debt to EBITDA ratio of 5.1 times at cost on our cash flow loans.”

“In this environment, we have not only been extremely selective, but we have generally moved up capital structure to more secured investments. Reminder about our long-term track record, PNNT was in business since 2007, then as now focused on financing middle-market financial sponsors. Our performance through the global financial crisis and recession was solid. Prior to the onset of the global financial crisis in September 2008, we initiated investments, which ultimately aggregated $480 million. Average EBITDA of that underlying portfolio was down about 7% to the bottom of the recession. Our focus continues to be on companies and structures that are more defensive, have a low leverage, strong covenants and are positioned to weather different economic scenarios.”

For the quarter ended June 30, 2018, net asset value (“NAV”) per share increased by 1.0% (from $9.00 to $9.09) partially due to the previously discussed accretive share repurchases and net realized/unrealized gains of over $5.1 million. More importantly, the company continues to deliver net “realized” gains from exiting investments including $17.4 million during the recent quarter and a total of $43.0 million over the last three quarters.

“During the quarter ended June 30, unrealized loss from investment was $14 million, or $0.20 per share. Unrealized gains on our debt instruments was $2 million or $0.02 per share. We had about $17 million or about $0.25 per share of realized gains. The accretive effect of our share buyback was about $0.03 per share, excess dividends over income was about $0.01 per share. Consequently, NAV per share went from $0.09 per share to $9.09 per share.”

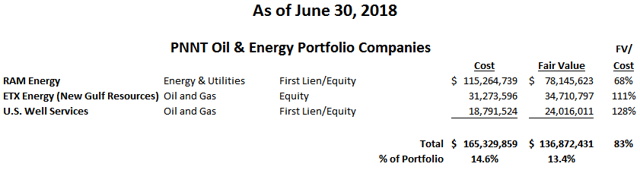

Total direct exposure to oil and energy-related investments account for around $137 million or 13.4% of the portfolio fair value.

On November 5, 2018, Matlin & Partners Acquisition Corporation (NASDAQ: MPAC, MPACU, MPACW), announced that shareholders have approved MPAC’s merger with U.S. Well Services, (“USWS”). PNNT’s loans will be refinanced and its equity position will be publicly traded and was discussed on the recent call:

“As a result of the proposed merger, our $10 million loan will be refinanced. The equity position we made for $7 million of cost was marked at about $12 million at June 30, approximating the value of the stock in the proposed merger. Based on this valuation, our overall investment in U.S. Well has generated an IRR of 18% and 1.7 times multiple on invested capital.”

Q. “On your investment in U.S. Well Services. I’m just curious, after that transaction is completed, I think, you said, you expect fourth quarter of this year. Do you expect to be able to exit your equity position shortly after or is there any sort of mandatory lockup period that follows close?”

A. “So there is 50% lockup for six months and another 50% at 12 months. Look, I think, if you look at the comps, we think U.S. Well even at this price is cheap and as a reasonable start to trade up in generally more NAV upside for our shareholders.”

RAM Energy and ETX Energy have previously sold non-core assets to generate liquidity/stability. As discussed in previous reports, its investment in RAM Energywas restructured to reduce the amount of PIK income and ETX Energy was previously restructured resulting in realized losses but potential equity upside potential. These investments will likely be monetized/sold at some point and were discussed on the recent call:

“With regard to our two remaining equity names, RAM and ETX they have been aided by the higher oil and gas prices, it will take time for us to maximize our recovery. We are encouraged that the energy markets are rebounding, this enhances the M&A environment in the section and our ability to evaluate strategic options for our remaining equity related companies.”

“With regard to our energy related portfolio, we are pleased we continue to make progress monetizing those investments on reasonable values. We started 2018 with four investments in energy with the stated goal of monetization over time. We held these investments over the last several years during the energy downturn with the goal of maximizing value over the long run. We believe that we are starting to see the fruits of that strategy. You may remember that last quarter, we exited the first of those names, American Gilsonite, which ended up generating an 8.6% IRR and 1.4 times multiple on invested capital of our whole period of 5.5 years.”

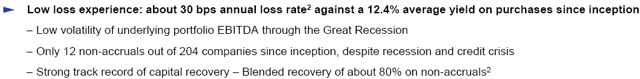

There were no investments on non-accrual as of June 30, 2018:

“We’ve had only 12 companies going non-accrual out of 204 investments since inception over 11 years ago. Further, we are proud that even when we had those non-accruals we’ve been able to preserve capital for our shareholders, through hard work, patients, judicious additional investments in capital and personnel in those companies, we’ve been able to find ways to add value. Based on the values as of June 30, today we have recovered about 80% of capital invested on the 12 companies that have been on non-accrual since inception of the firm. We currently have no investments on non-accrual.”

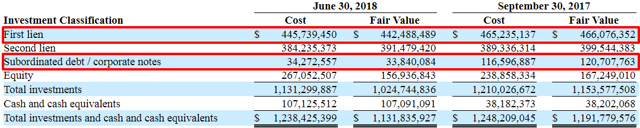

The company will likely use higher leverage in the coming quarters and continue to increase the amount of first-lien positions that recently increased from 40% to 43% of the portfolio. Also, as shown in the table below, the company has reduced the amount of subordinated debt from $121 million to $34 million, or from 10% to 3% of the portfolio, over the last three quarters.

“Our overall portfolio consisted of 51 companies with an average investment size of $20.1 million, had a weighted average yield on interest bearing debt investments of 11.4% and was invested 43% in first lien secured debt, 38% in second lien secured debt, 3% in subordinated debt and 16% in preferred and common equity”

PNNT Pricing & Recommendations:

For target prices, dividend coverage and risk profile rankings, credit issues, earnings/dividend projections, quality of management, fee agreements, and my personal positions on all BDCs (including this one) please see Premium Reports.