The following is a quick ARCC Update that was previously provided to subscribers of Premium BDC Reports along with revised target prices, dividend coverage and risk profile rankings, potential credit issues, earnings/dividend projections, quality of management, fee agreements, and my personal positions for all business development companies (“BDCs”).

ARCC Risk Profile Update

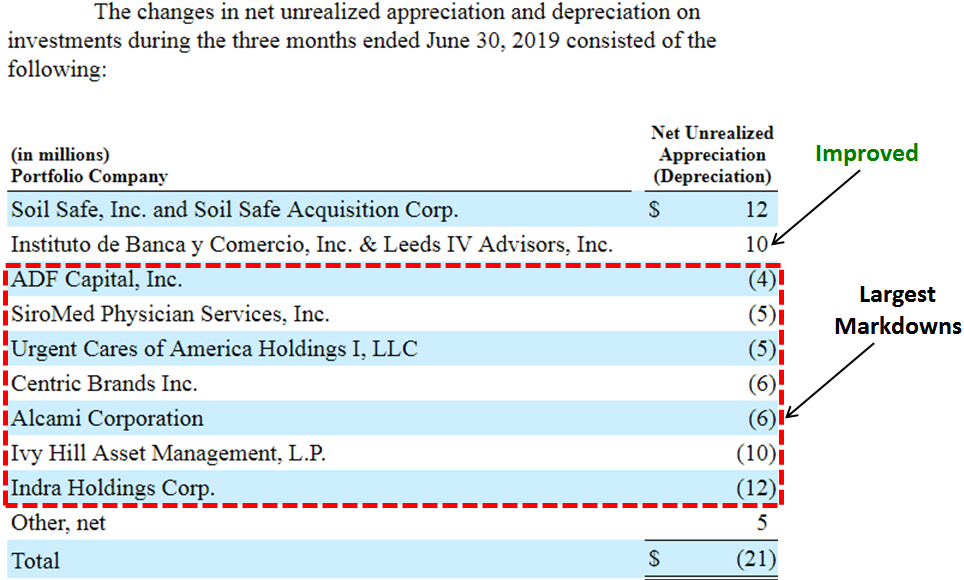

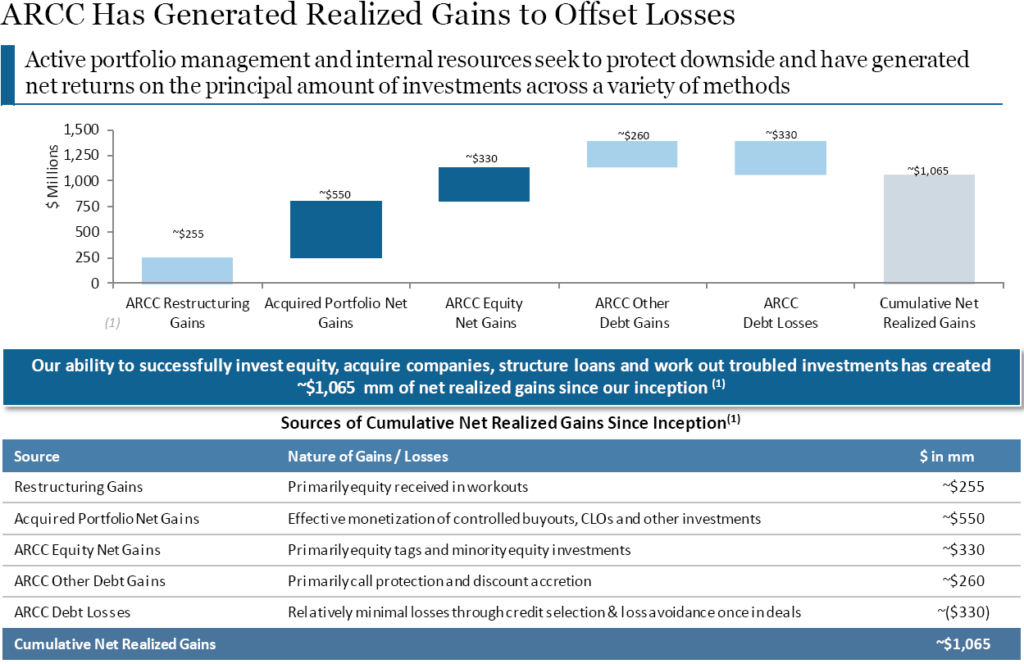

I consider ARCC to have one of the safer BDC risk-profiles with consistently lower non-accruals, historical net realized gains and net asset value (“NAV”) per share growth. During Q2 2019, NAV per share increased by 0.3% or $0.06 per share from $17.21 to $17.27 due to overearning the dividend(S) by $0.07 per share partially offset by net unrealized depreciation. Some of the largest markdowns were investments on my watch list including Indra Holdings Corp., Ivy Hill Asset Management (was previously marked up), Alcami Corporation, Centric Brands, Urgent Cares of America Holdings, SiroMed Physician Services, and ADF Capital.

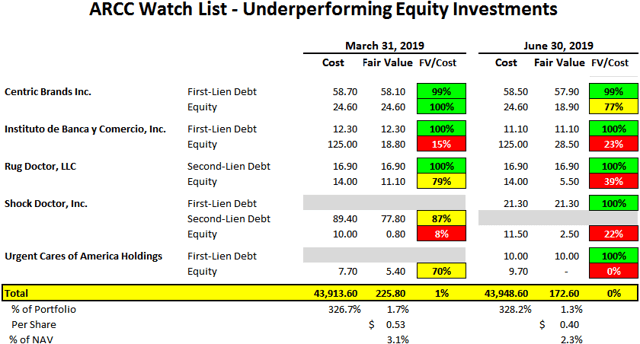

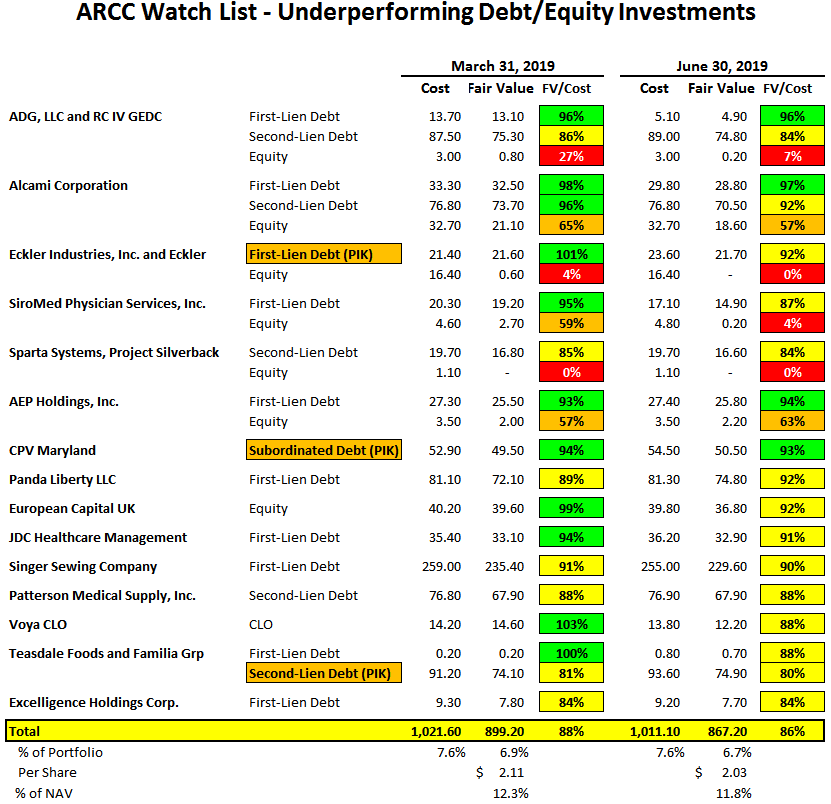

My primary concern is that only 3 of the 20 companies on my watch list that are not on non-accrual showed improvement (Panda Liberty, AEP Holdings, and Instituto de Banca y Comercio) during Q2 2019. ARCC’s second-lien position in Shock Doctor was refinanced and is now considered first-lien but the equity portion is still valued at 22% of cost as shown in the following table and needs to be watched.

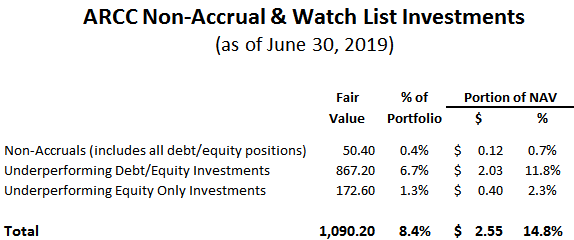

Non-accruals remain low and decreased slightly due to the previously discussed markdowns of Indra Holdings Corp. and ADF Capital as well as Javlin Three. However, its $25 million second-lien loans to WASH Multifamily and Coinamatic were added to non-accrual status during Q2 2019 and are still marked around 98% of cost as shown below. If non-accruals were completely written off, it would impact NAV per share by around $0.12 or 0.7%:

—

My primary concern is additional unrealized losses from companies that have been previously marked down (including equity positions) and shown in the previous and following tables.

—

The following table summarizes the information from the previous tables and I will update each quarter as well as tracking the details for each company and provide updates to subscribers of Premium BDC Reports when available.

—

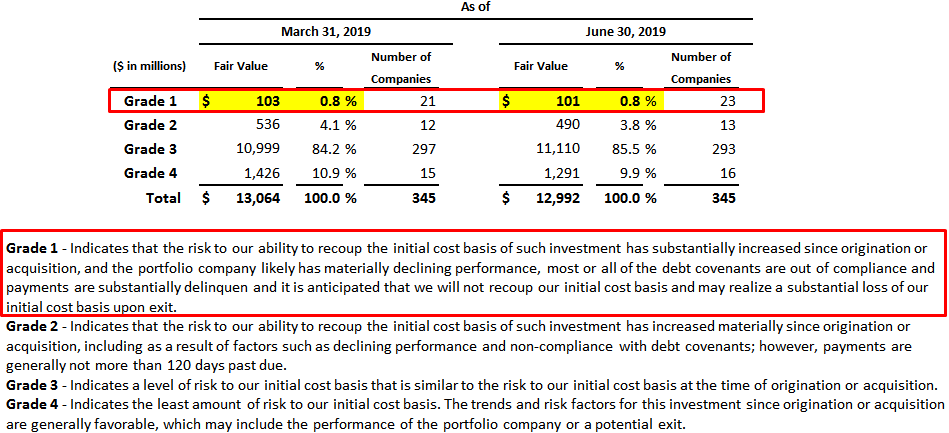

The information in the following table was provided by the company showing the grade of the investments in the portfolio at fair value but does not include detail by portfolio company:

—

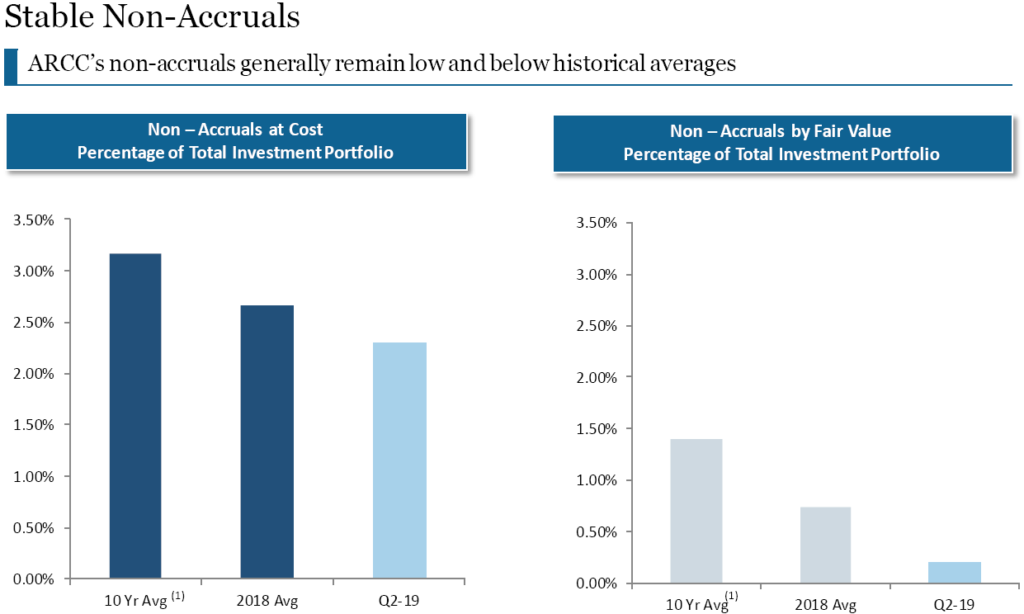

It is important to note that ARCC has investments in around 345 companies so there will always be a certain amount of credit issues but historically non-accruals have remained low:

—

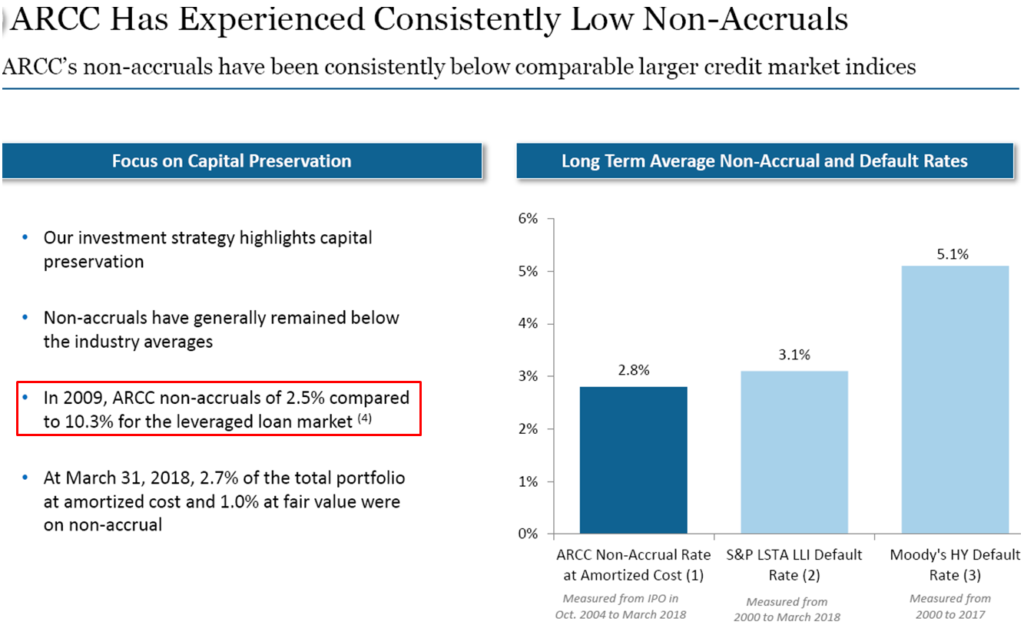

During the 2008/9 financial crisis, ARCC had non-accruals of around 2.5% and much lower than the average leveraged lender:

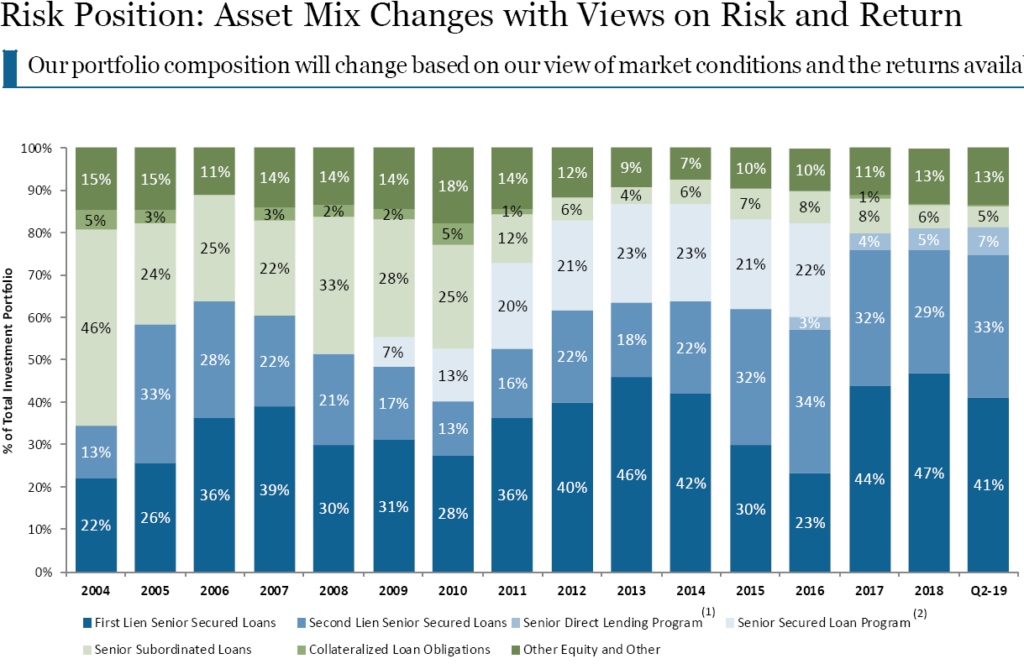

Its portfolio asset mix continues to shift from first-lien positions toward second-lien and its SDLP now with 41% first-lien (was 47% as of Q4 2018), 33% second-lien (was 29% as of Q4 2018), 7% of subordinated certificates of the SDLP (was 5% as of Q4 2018), 5% of senior subordinated loans, and 14% in other and preferred equity securities that should decline over the coming quarters due to portfolio rotation out of non-core assets.

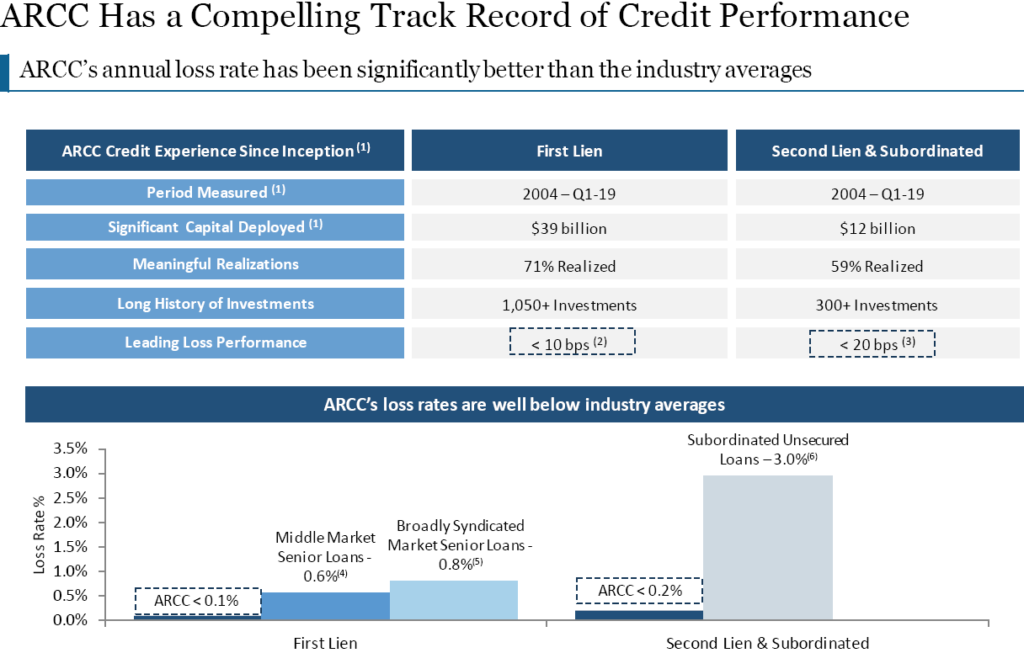

However, It should be pointed out that ARCC’s second-lien investments are likely safer with better security than other BDCs as discussed by management:

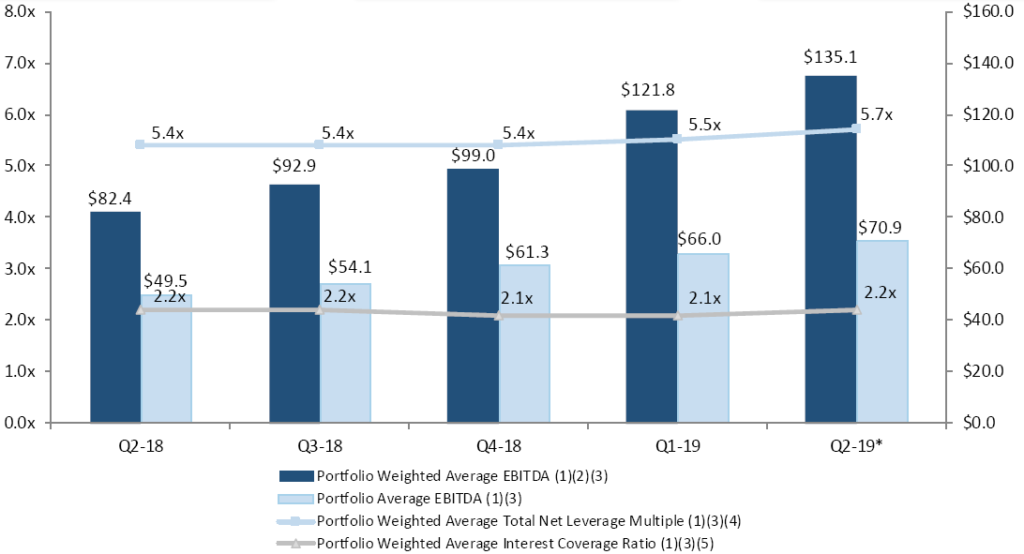

Q. “Can you give us some color on your appetite for second lien? Obviously, it’s been — it increased over the last year a tiny bit as a percentage of portfolio not much. But obviously also your weighted-average EBITDA has been going up.”

A. “Yes, generally, we’ve said this to you in the past most of our large second lien deals are in companies that have been with the portfolio for a longer period of time. We tend to be in larger businesses that we think have better downside protection and they tend to be in industries that we think of as very defensive and not cyclical.”

“Credit quality continues to be very stable. Our portfolio continues to generate weighted average EBITDA growth of 4% over the past 12 months. We do not add any new portfolio of companies to non-accrual in the second quarter and our non-accruals remain stable at 2.3% of the total portfolio like amortized cost and 0.2% at fair value.”

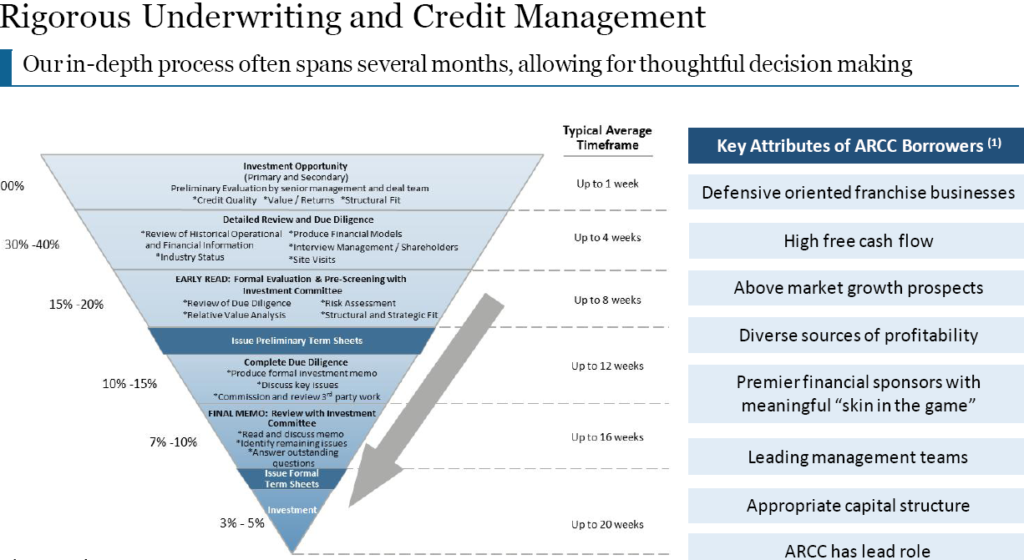

“In these types of aggressive markets, we become even more selective. Our selectivity ratio this quarter was 2% which is about half of our historical average of approximately 4% and we refer to that in terms of the percentage of deals that we see — that we close rather versus those that we see. It has been trending lower over time and that’s reflective of our disciplined approach. We’re trying to stick to the playbook that we’ve had for a long time of having conservative structure with real covenants and loan documents that actually allow us to enforce in a position, where we need to. And I think it’s allowed us to achieve better recoveries and fewer losses than competitors.”

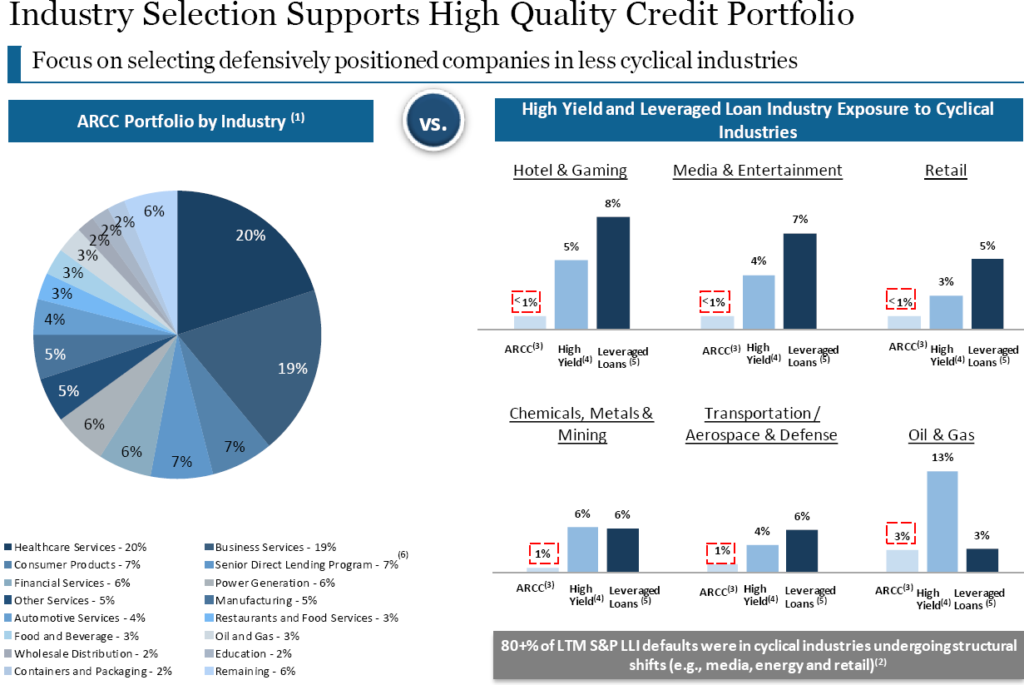

“We think that industry selection is key. And we think not being frankly in unsecured positions at this stage in the cycle are the two keys and to stay away from cyclical industries and frankly stay away from sub-debt for now. And we’ve been spending years as it continues to be late in the cycle trying to exit the companies from our portfolio that were not performing to plan. So we’re happy with where we are. We don’t see anything here in the near term that’s kind of change what today is an attractive place to invest where there’s a lot of income relative to the risk-free rate and good credit quality.”

—

This information was previously made available to subscribers of Premium BDC Reports, along with:

- ARCC target prices and buying points

- ARCC risk profile, potential credit issues, and overall rankings

- ARCC dividend coverage projections and worst-case scenarios

- Real-time changes to my personal portfolio

To be a successful BDC investor:

- As companies report results, closely monitor dividend coverage potential and portfolio credit quality.

- Identify BDCs that fit your risk profile.

- Establish appropriate price targets based on relative risk and returns (mostly from regular and potential special dividends).

- Diversify your BDC portfolio with at least five companies. There are around 50 publicly traded BDCs; please be selective.