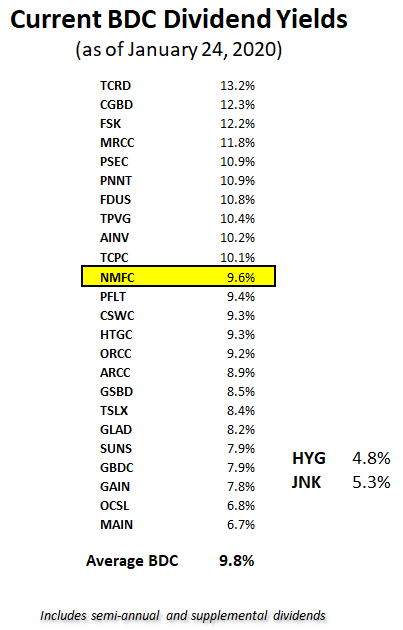

The following is from the NMFC Deep Dive that was previously provided to subscribers of Premium BDC Reports along with revised target prices, dividend coverage and risk profile rankings, potential credit issues, earnings/dividend projections, quality of management, fee agreements, and my personal positions for all business development companies (“BDCs”).

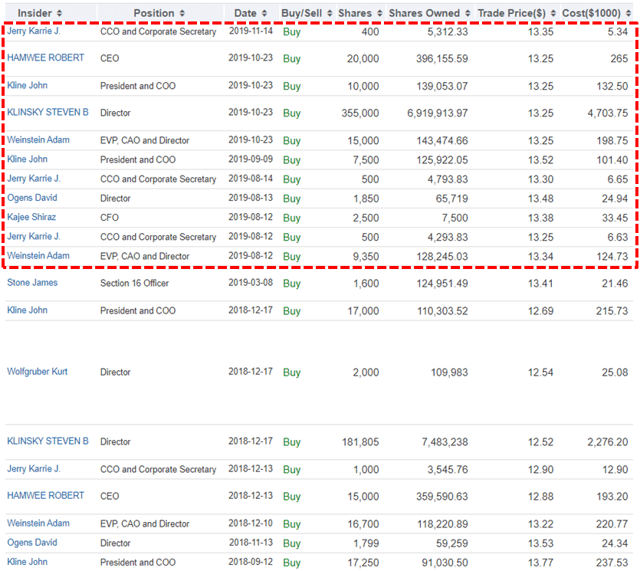

NMFC Recent/Previous Insider Purchases:

In Q3 2019, management was purchasing additional shares at lower prices of around $13.25 to $13.52 per share.

Steve Klinsky, Founder, CEO and Chairman: “I and other members of New Mountain continue to be very large owners of our stock, with aggregate ownership of 10.5 million shares today, inclusive of the 400,000 shares purchased in our most recent equity issuance.”

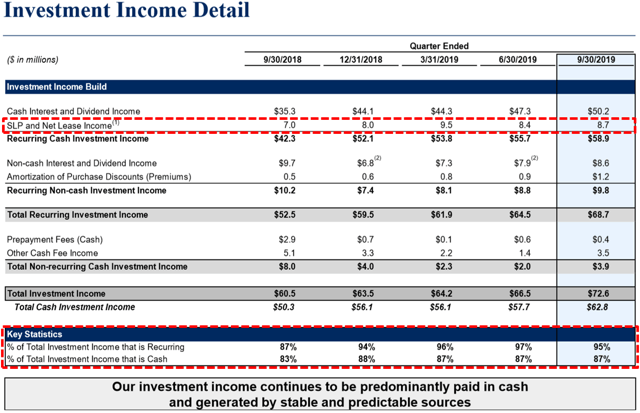

NMFC Dividend Coverage Update:

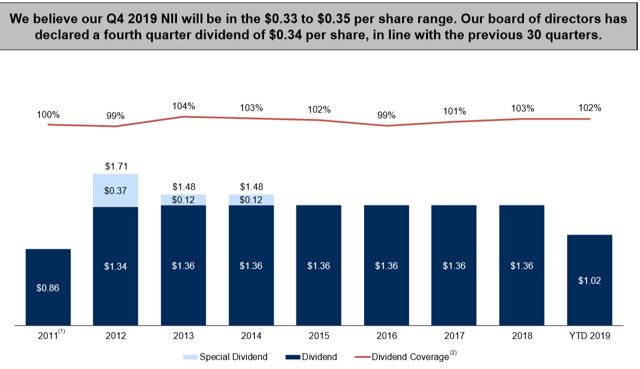

NMFC has consistently covered its dividend since its IPO with mostly “cash income generated by stable and predictable sources” as shown below.

“As slide 27 demonstrates our total investment income is recurring in nature and predominately paid in cash. As you can see, 95% of total investment income is recurring and cash income remains strong at 87% in this quarter. We believe this consistency shows the stability and predictability of our investment income”

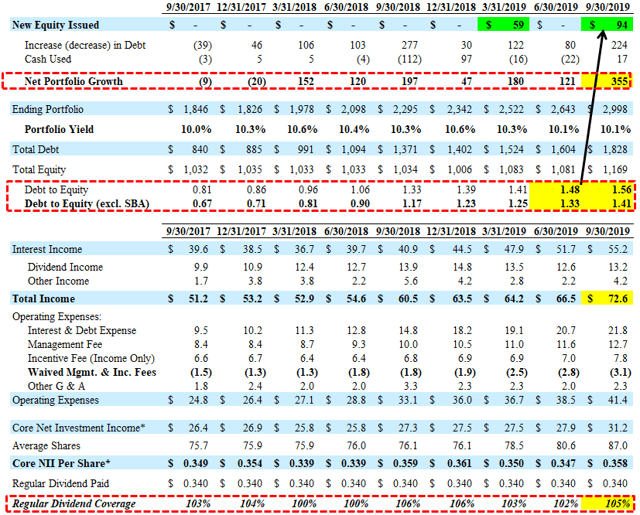

As discussed in previous reports and shown below, income from recurring sources (including its SLPs) has increased over the previous quarters and accounted for 95% of total income in Q3 2019. However, there was a decline in the amount of income from its fully ramped its NMFC Senior Loan Program III LLC (“SLP III”):

—————–

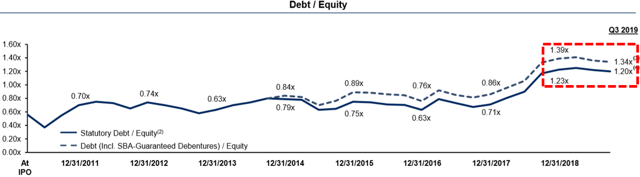

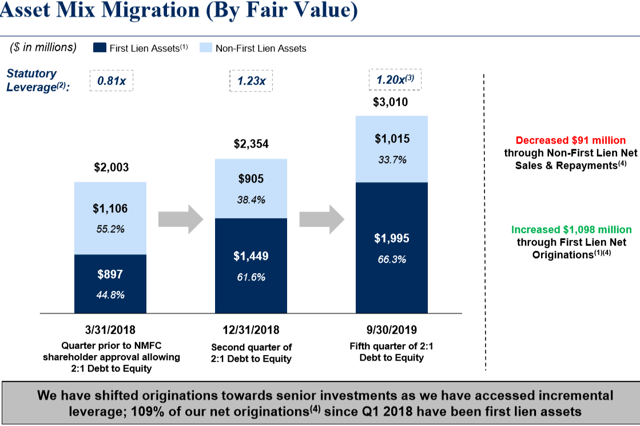

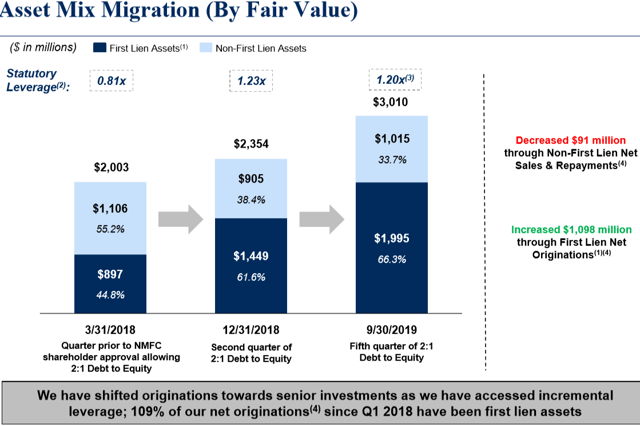

The company was firmly above its previous targeted leverage that was recently increased due to shareholder approval to increase leverage (effective June 9, 2018). The company previously amended its credit facility and note agreements to include a requirement that the company does not exceed a total debt-to-equity ratio of 1.65 to 1.00. However, management is targeting a statutory debt-to-equity ratio between 1.20 and 1.40 depending on the amount of first-lien debt as a percentage of the total portfolio and I have taken into account with the updated projections.

“We have seen significant growth in the portfolio over the last year as we have increased our statutory leverage from 0.81 to 1.20, inclusive of our October equity offering. Consistent with the strategy we articulated when we received shareholder authorization to increase leverage, the preponderance of our asset increase has been in the form of senior loans. The step-up in leverage over the past three quarters is in line with our new target statutory debt to equity ratio of 1.2 times to 1.4 times.”

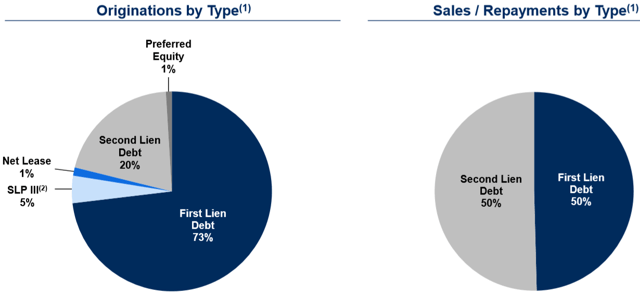

“Our mix of originations continues to skew meaningfully towards first lien loans, accounting for 73% of total new originations this quarter. Our sales and repayments were balanced evenly between first and second lien assets. Overall, our Q3 mix showed a continued shift towards first lien assets, consistent with our stated plan to avoid increased portfolio level leverage with a more senior-oriented asset mix.”

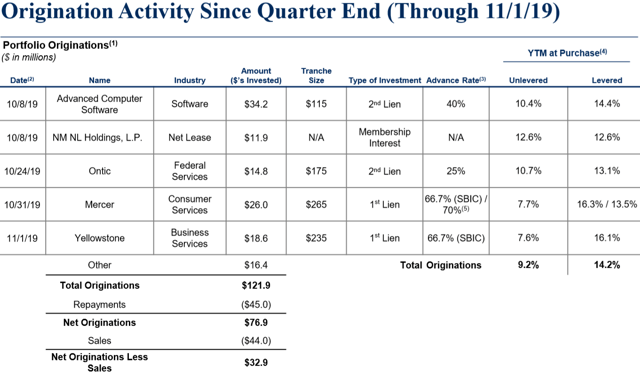

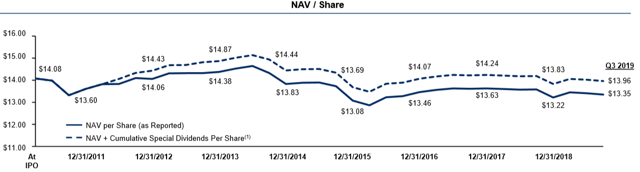

As mentioned earlier, on October 25, 2019, NMFC completed its offering of 9.2 million shares at a price of $13.25 per share. The Investment Adviser paid a $0.35 per share portion of the $0.41 per share underwriters’ sales load for net proceeds of $13.60 per share or $125 million. NMFC had around $122 million of originations and commitments since the end of Q3 2019through November 1, 2019, and management is expecting to fully invest in the proceeds from recent equity offering:

Robert Hamwee, CEO, commented: “The third quarter represented another strong quarter of performance for NMFC. We originated $452 million of investments and once again had no new investments placed on non-accrual. Additionally, after our recent equity raise in October, we anticipate remaining fully levered in the fourth quarter.”

“Page 19 shows our continued origination momentum since the end of the quarter, where we have invested $122 million in new transactions, with $89 million of sales and repayments. Notable post quarter end transactions included a new net lease deal originated in our REIT subsidiary and 2 new loans purchased in our SBIC investing program, which we continue to expand.”

“For Q4 pace of originations for the balance of the quarter, we wouldn’t expect Q4 to be as heavily — origination Q3. I think that was an idiosyncratically very strong quarter. But we do have a robust pipeline, as John mentioned, and we’d certainly expect to see significant addition to the portfolio through the end of the year.”

“On October 8, 2019, the SEC issued an exemptive order (the “New Order”) permitting us and certain of our affiliates to co-invest together in portfolio companies subject to certain conditions included therein. The New Order supersedes our existing co-investment exemptive order, which was granted by the SEC on December 18, 2017, and expands on our ability to co-invest with certain affiliates.”

—————–

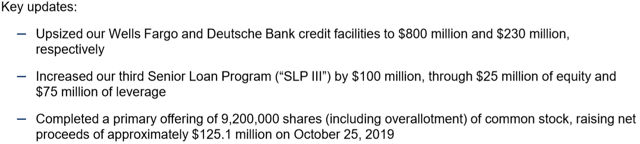

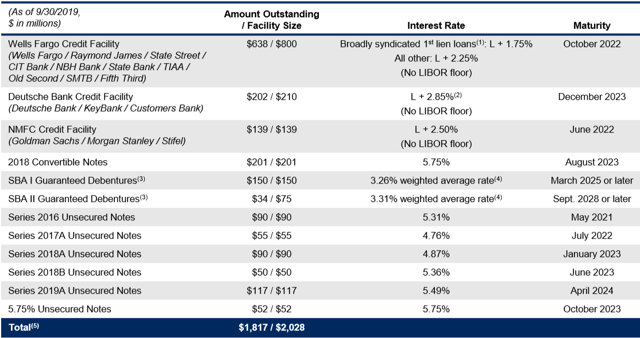

On October 16, 2019, the company entered into a Joinder Agreement pursuant to which Hitachi Capital America Corp. was added as a lender under the DB Credit Facility for an aggregate commitment of $20 million thereby increasing the aggregate commitments under the DB Credit Facility from $210 million to $230 million.

“Taking into account SBA-guaranteed debentures, we had over $2 billion of total borrowing capacity at quarter end. During Q3, we successfully upsized both our Wells Fargo and Deutsche Bank credit facilities by $80 million and $60 million, respectively. Finally, on Slide 30, we show our leverage maturity schedule. As we’ve diversified our debt issuance, we have been successful at laddering our maturities to better manage liquidity. We currently have no near-term maturities.”

On August 12, 2019, NMFC amended and increased its Deutsche Bank Credit Facility from $150 million to $210 million. There will likely be additional issuances of unsecured notes similar to the $52 million at 5.75% due October 2023 publicly traded under the symbol “NMFX” that are included in the BDC Google Sheets.

As of September 30, 2019, the company had cash equivalents of almost $70 million and over $211 million of available borrowing capacity under its credit facility and SBA debentures.

—————–

For Q3 2019, NMFC reported near its best-case projections with another quarter of active portfolio growth fully covering its dividend since its IPO. The company continues to increase its use of leverage to offset the impact from lower portfolio yields.

“NMFC’s asset-level portfolio yield has declined since Q1 due to the downward shift in the LIBOR and 20 basis points of the decline is due to the aforementioned shift towards first-lien in assets. We have offset this decrease in asset-level yield, primarily through our proactive strategy of increasing portfolio-level leverage. While we are mindful of the potential continued decrease in LIBOR, we remain comfortable with our portfolio yield which solidly supports our quarterly dividend.”

—————–

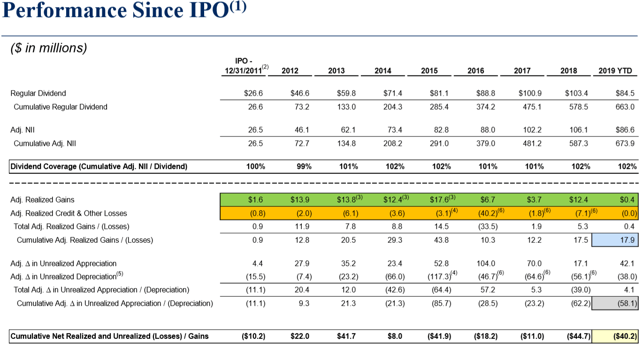

“First, we look at realized gains and realized credit and other losses. As you can see looking at the row, highlighted in green, we’ve had success generating real economic gains every year through a combination of equity gains, portfolio company dividends and trading profits. Conversely, realized losses, including default losses, highlighted in orange, have generally been smaller and less frequent, and show that we are typically not avoiding nonaccruals by selling poor credits at a material loss prior to actual default. As highlighted in blue, we continue to have a net cumulative realized gains, which currently stands at $18 million. Looking further down the page, we can see that cumulative net unrealized depreciation, highlighted in gray, stands at $58 million, and cumulative net realized and unrealized loss, highlighted in yellow, is at $40 million. The net result of all this is that in our over 8 years as a public company, we have earned net investment income of $674 million against total cumulative net losses, including unrealized, of only $40 million.”

There is the potential for increased earnings in the coming quarters with additional leverage available through its previously approved second SBIC license, additional SLPs and the continued ramp of its real-estate entity “Net Lease” structured as a REIT. Its SLPs currently account for 7% of the portfolio with expected returns between 11% and 13% and its Net Lease accounts for around 4% of the portfolio with expected returns in the “low-to-mid teens”.

NMFC Risk Profile Update:

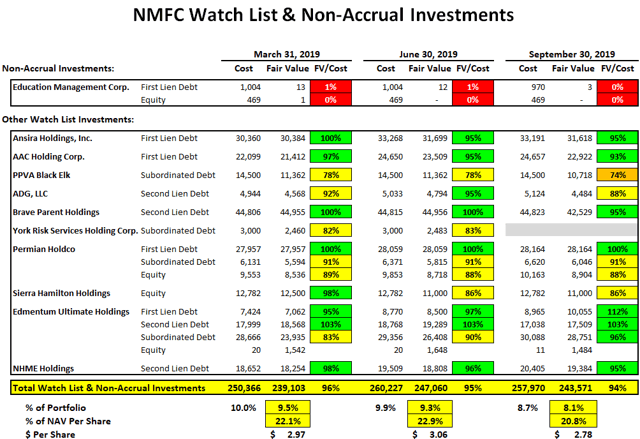

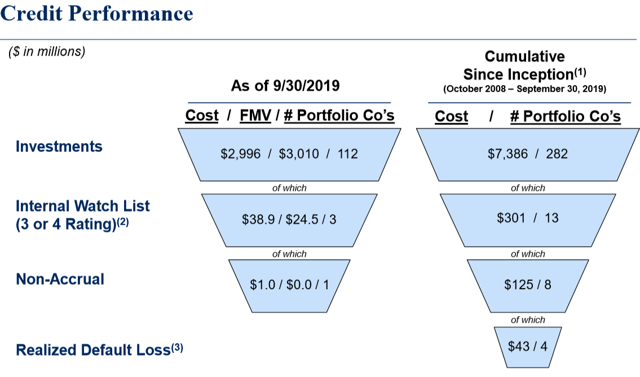

For the fifth quarter in a row, and for 10 out of the last 11 quarters, there were no new non-accruals in the portfolio. Previously, its first-lien positions in Education Management (“EDMC”) were placed on non-accrual status as the company announced its intention to wind down and liquidate the business. As of September 30, 2019, the company’s investments in EDMC had a cost basis of $1.0 million and fair value of $0.0 million. Portfolio credit quality remained stable with only EDMC (0% of the portfolio) with an investment rating of “4”. An investment rating of a “4” includes non-accruals or investments that could be moved to non-accrual status, and the final development could be an actual realization of a loss through a restructuring or impaired sale.

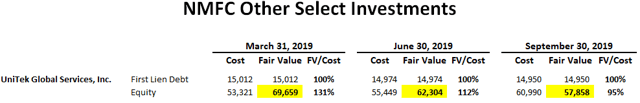

For Q3 2019, net asset value (“NAV”) per share decreased by $0.06 or 0.3% from ($13.41 to $13.35) due to markdowns of previously discussed investments including its equity investments in UniTek Global Services (similar to Q2 2019) and was discussed on the recent call:

“The new name on the list is the previously restructured Unitek representing 2 different securities, CL and CN, for a few operational missteps led to weaker financial results in 2019, but where secular trends continue to be strong in the company’s key operating division, providing us with optimism for improvement in 2020.”

Management also discussed UniTek on the previous call:

Q. “UniTek seem to have been a driver this quarter unrealized markdowns, is there any key shift I know you’ve been — this has been obviously a longstanding name that has required attention.”

A. “Yeah. I mean, the high-level color is it’s nothing that we think has any impact on the long-term realizable value of UniTek. There were a couple of operating hiccups at the company in the last quarter. And we try to be sort of real time from a valuation perspective, and in fact as a percentage of the overall position, even the change wasn’t bad meaningful. But we don’t think anything that’s happened there as any impact on our long-term ability to recognize and create value there as one of our kind of key equity portfolio companies. Obviously update everybody and as that evolves.”

Brave Parent Holdings which provides security software solutions was added to the watch list and marked down during Q3 2019 to 95% of cost. The company was recently rated by Moody’s and needs to be ‘watched’ due to high leverage and “execution risk surrounding the integration and restructuring activities related to the recent BeyondTrust and Avecto acquisitions”:

Moody’s Investors Service: “Brave Parent Holdings, Inc.’s (“BeyondTrust”) B3 Corporate Family Rating is constrained by its high financial risk profile, due in part by its very high leverage following the LBO, Avecto and BeyondTrust acquisitions. The rating also reflects the highly competitive privileged access management (“PAM”) market, along with execution risk surrounding the integration and restructuring activities related to the recent BeyondTrust and Avecto acquisitions. However, the rating is supported by BeyondTrust’s leading market position in the PAM and secure remote support markets, along with the strong track record of organic growth. Additionally, the company’s strong retention rates and recurring revenue allow for healthy free cash flow generation.”

NMFCs’ ‘watch list’ is around 8% of the portfolio and includes previously discussed investments including NHME Holdings, Permian Holdco, Ansira Holdings, AAC Holding, PPVA Black Elk, ADG LLC, and Sierra Hamilton. Many of these investments were marked during the quarter including PPVA that remains in a “liquidating trust” and was discussed on the recent call including being valued at 74% of cost which “reflects the midpoint of likely scenarios”:

“Credit performance continues to be strong, with material quarter-over-quarter credit deterioration in only one significant name, PPVA, which has effectively been an ongoing liquidating trust under Cayman law for a number of years, and which has been added to our internal watch list as a 3. As our one significantly troubled asset, we continue to spend a lot of time attempting to maximize our recoveries from the PPVA entity to state. Given the complex mix of underlying assets and litigation claims, while we believe our valuation of $0.74 currently fairly reflects the midpoint of likely scenarios, significant volatility exists around the midpoint.”

The markdowns for UniTek, Brave Parent, and PPVA were partially offset by a markup in Edmentum Ultimate Holdings that was previously restructured and “operating results and enterprise value continue to meaningfully improve”:

“There are currently three names that have had negative migration of 2.5 turns or more. Two are names we have discussed for many previous quarters, the previously restructured Edmentum, where operating results and enterprise value continue to meaningfully improve.”

Its investment in NHME was previously on non-accrual and then restructured in November 2018 resulting in a material modification of the original terms and an extinguishment of its original investments in NHME driving a realized loss. As a result of the restructuring, NMFC received second lien debt in NHME and common shares. In addition, NMFC funded additional second lien debt and received warrants to purchase common shares for this additional funding.

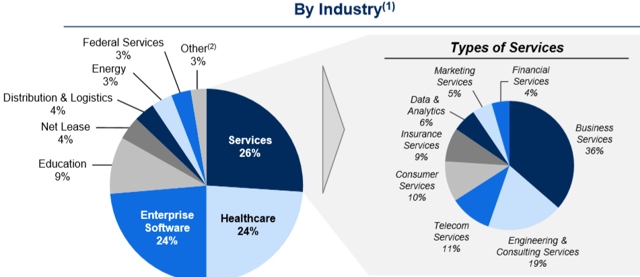

NMFC has oil/energy-related exposure of around 3% of the total portfolio including Tenawa Resource (large scale natural gas processing plant), Sierra Hamilton (provider of services to oil and gas industry) and Permian Tank (supplier of above-ground storage tanks and processing equipment to oil and gas exploration/production).

—————–

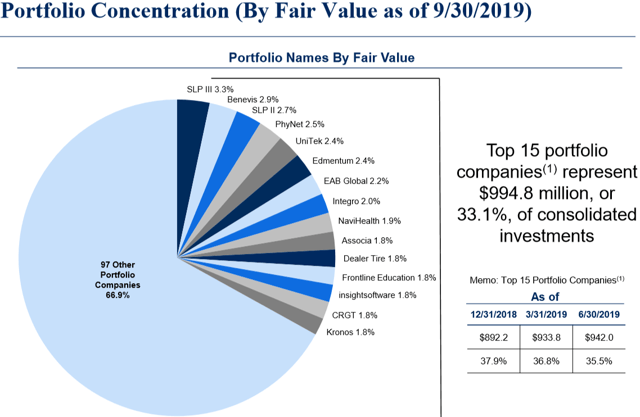

The company has a safer-than-average portfolio for many reasons including its focus on “defensive growth” middle-market companies and mostly secured debt investments of first and second-lien that account for 82% of the portfolio. Also, management has been forthcoming with information related to potential underperforming assets.

“We have a diversified portfolio with our largest investment at 3.3% of fair value, and top 15 investments accounting for 33% of fair value. We have added more position diversity in each of the last 4 quarters to decrease our risk to any one borrower.”

“Since the inception of our debt investment program in 2008, we have taken a New Mountain’s approach to private equity and applied it to corporate credit, with a consistent focus on defensive growth business models and extensive fundamental research with an industry that are already well known to New Mountain. Or more simply put, we invest in recession resistant businesses that we really know and really like. We believe that this approach results in a differentiated and sustainable model that allows us to generate attractive, risk adjusted rates of return across changing cycles and market conditions.”

As mentioned earlier, the company will likely invest in higher amounts of first-lien assets at lower yields, shifting the portfolio back to historical levels:

“Our mix of originations continues to skew meaningfully towards first lien loans, accounting for 73% of total new originations this quarter. Our sales and repayments were balanced evenly between first and second lien assets. Overall, our Q3 mix showed a continued shift towards first lien assets, consistent with our stated plan to avoid increased portfolio level leverage with a more senior-oriented asset mix.”

From previous call: “Our expectation is that the portfolio will be 50% first lien, 50% non-first lien plus or minus 10% in either direction, so 60/40 or 40/60. To be clear though irrespective of the rate environment or the spread environment we are not interested in increasing risk in the portfolio. Now, we have the view that there are second liens we do that are frankly less risky than first liens that we do.”

First-lien debt increased slightly to 55.5% (previously 52.3%) of the portfolio as the company “shifted originations towards senior investments as we have accessed incremental leverage”.

Out of $7.4 billion of investments in 282 portfolio companies, only 8 representing just $125 million of cost have migrated to non-accrual and only 4 representing $43 million of cost has resulted in a realized default loss (see below). The $43 million includes the previously discussed $15 million realized loss from NHME and another $28 million associated with its investment in Transtar Holding Company as discussed at the end of this report.

This information was previously made available to subscribers of Premium BDC Reports, along with:

- NMFC target prices and buying points

- NMFC risk profile, potential credit issues, and overall rankings

- NMFC dividend coverage projections and worst-case scenarios

- Real-time changes to my personal portfolio

To be a successful BDC investor:

- As companies report results, closely monitor dividend coverage potential and portfolio credit quality.

- Identify BDCs that fit your risk profile.

- Establish appropriate price targets based on relative risk and returns (mostly from regular and potential special dividends).

- Diversify your BDC portfolio with at least five companies. There are around 50 publicly traded BDCs; please be selective.