The following information was previously provided to subscribers of Premium BDC Reports along with:

- GBDC target prices/buying points

- GBDC risk profile, potential credit issues, and overall rankings

- GBDC dividend coverage projections and worst-case scenarios

This update discusses Golub Capital (GBDC) which is a BDC with ‘higher quality’ management, access to SBIC leverage, and its higher credit quality portfolio. GBDC has one of the most investor-friendly fee structures, with a base management fee that is calculated at an annual rate of 1.375% (compared to 1.50% to 2.00%, for many) of average adjusted gross assets, excluding cash and cash equivalents. GBDC’s fee structure includes a ‘total return hurdle’ which means that its incentive fee structure protects total returns to shareholders by taking into account capital losses when calculating the income portion of the fee. Incentive fees are paid after the hurdle rate is reached, requiring a minimum return on net assets of 8% annually. Once this hurdle is reached, the advisor is entitled to 100% of the income up to 10%. This ‘catch-up’ provision catches up the incentives to 20% of pre-incentive fee net investment income and then the advisor is paid 20% after the ‘catch-up’. However, GBDC is currently between the 8% and 10% hurdles so its incentive fees are much lower and basically ensures dividend coverage.

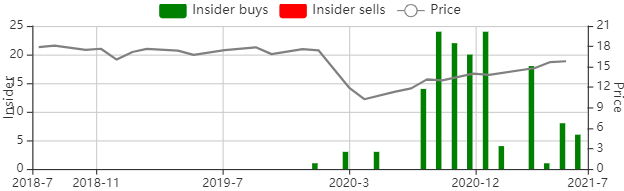

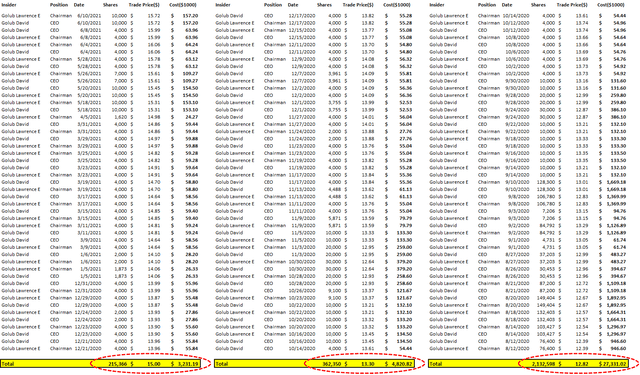

GBDC Recent Insider Purchases

- The Chairman and CEO have purchased over $35 million of common shares over the last 10 months.

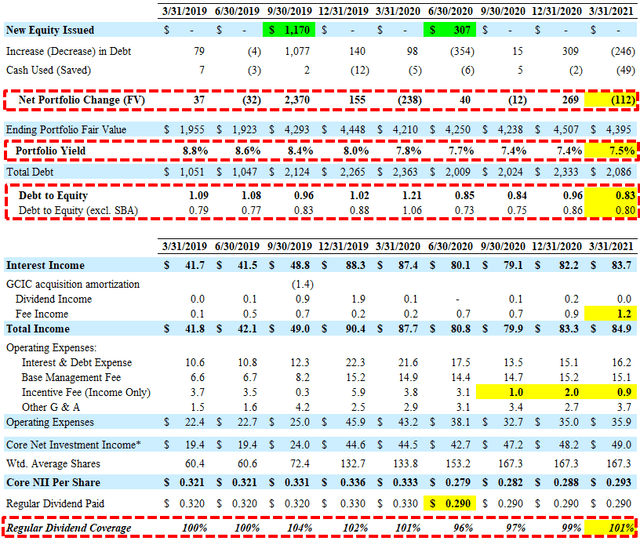

GBDC Dividend Coverage Update

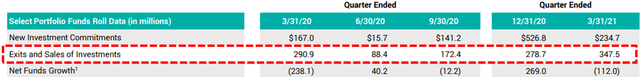

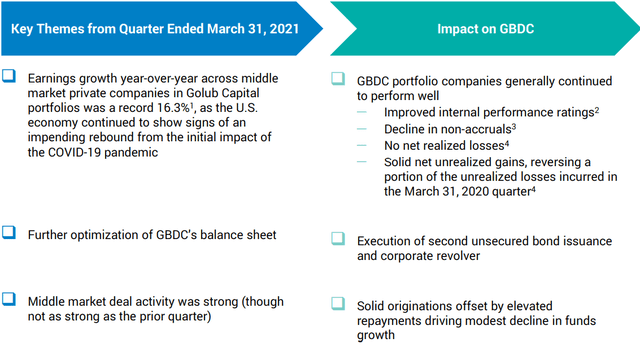

I am expecting improved dividend coverage over the coming quarters for many reasons including portfolio growth through increased leverage, improved net interest margins, and recent/continued increases in its NAV per share. For the three months ended March 31, 2021, GBDC hit its best-case projections with slightly increased portfolio yield (from 7.4% to 7.5%) and higher fee income partially offset lower portfolio growth (decline). Leverage (debt-to-equity) declined due to increased NAV per share and repayments/sales/exits exceeding new investments for the quarter. NAV per share increased by another 1.8% “primarily attributable to portfolio companies that generally continued to perform well. Strong performance across the portfolio was reflected in our internal performance ratings that have largely returned to pre-COVID levels.”

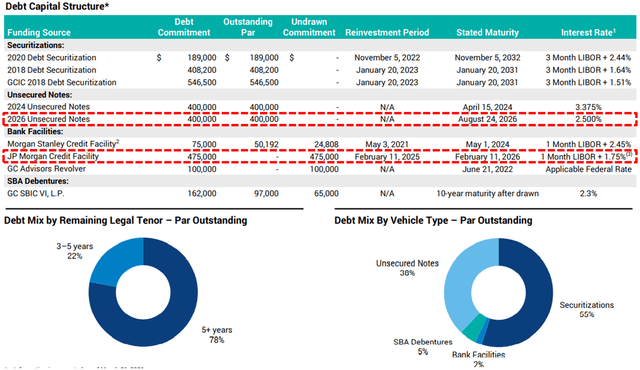

On February 24, 2021, GBDC closed an offering of $400 million of unsecured notes at 2.500% due in 2026. This is an excellent fixed rate for flexible unsecured borrowings and improves the overall strength of the balance sheet as well as lowering the overall borrowing rate.

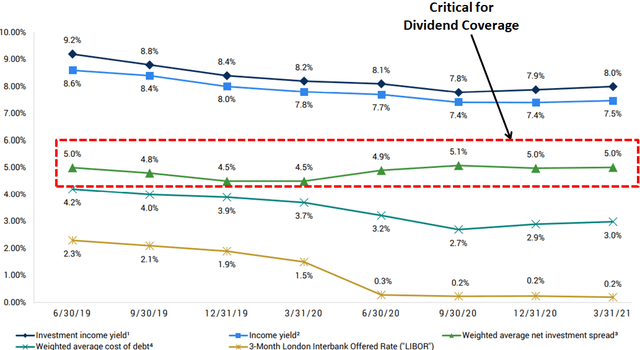

As shown in the following chart, the net interest margin (green line) previously increased to 5.1% but declined slightly due to the higher weighted average cost of borrowings. Similar to all BDCs, management is working to reduce borrowing rates including the recently issued notes at 2.50% and lower-cost credit facilities. On February 11, 2021, GBDC entered into its $475 million JPM Credit Facility (one-month LIBOR plus 1.750% to 1.875%) and repaid its WF Credit Facility (one-month LIBOR plus 2.000%).

“GBDC took advantage of attractive market conditions to continue to optimize its balance sheet. We executed a second unsecured bond issuance, building on the success of our inaugural offering last year. We also closed a new corporate revolver. These financings are consistent with the strategy you have heard us discuss before, low-cost, flexible financing with limited near-term maturities.”

“On February 11th, we closed on a $475 million revolving credit facility with JPMorgan which matures on February 11, 2026, and has an interest rate that ranges from one-month LIBOR +1.75% to one-month LIBOR + 1.875%. Second, On February 24th, we issued $400 million of unsecured notes, which bear a fixed interest rate of 2.5% and mature on August 24, 2026. With the completion of our second unsecured debt issuance, our percentage of unsecured debt as a percentage of total debt increased to 38.0% as of March 31st. And finally, on February 23rd, we decreased the borrowing capacity under our revolving credit facility with Morgan Stanley to $75 million. After the end of the quarter, we further amended this revolving credit facility to, among other things, extend the reinvestment period through April 12, 2024, extend the maturity date to April 12, 2026, and reduced the interest rate on borrowings to one-month LIBOR + 2.05% from one-month LIBOR + 2.45%.”

Full BDC Reports

This information was previously made available to subscribers of Premium BDC Reports. BDCs trade within a wide range of multiples driving higher and lower yields mostly related to portfolio credit quality and dividend coverage potential (not necessarily historical coverage). This means investors need to do their due diligence before buying.