Summary

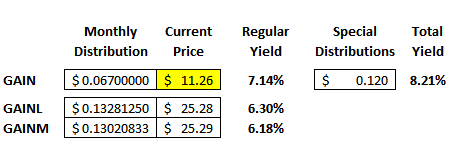

- Earlier this year, I initiated active coverage of GAIN (8.2% yield) and its preferred stocks GAINM (6.2% yield) and now its newly issued GAINL (6.3% yield).

- GAIN continues to focus on equity participation primarily responsible for growing its NAV per share and “recurring non-recurring” dividend income, that contribute to the growing amount of undistributed NII.

- Monthly dividends are mostly supported by interest and fee income from debt investments while semiannual dividends are generally supported by capital gains and dividend income from equity investments.

- As of today, GAIN is likely “oversold”, and I have recently purchased shares of GAINL for many reasons, including some discussed in this article.

You can read the full article at the following link:

Gladstone Investment

Earlier this year, I initiated active coverage of Gladstone Investment (GAIN) and its preferred stocks (GAINM) and the recently issued (NASDAQ:GAINL). As shown below, GAIN continues to outperform the S&P 500, UBS ETRACS Business Development Company ETN (NYSEARCA:BDCS) and UBS ETRACS 2X Leveraged Business Development Company ETN (NYSEARCA:BDCL). However, as mentioned in “14.5% Yielding ETN: Time To Buy Or Take Profits?” BDCL and BDCS should not be used as a longer-term investment for the BDC sector as they continually underperform the sector even after including distributions.

Please see the end of the is article for reasons to buy GAIN, including recently approached “oversold” conditions.

Reasons to Purchase GAIN

GAIN continues to focus on equity participation which is primarily responsible for growing its NAV per share and “recurring non-recurring” dividend income that contribute to the growing amount of undistributed spillover income used to support continued semiannual dividends. Currently, around 11% of GAIN’s distributions for 2018 are considered capital gains and will likely have favorable tax treatment.

GAIN will likely earn at least $0.20 per share each quarter covering 101% of its monthly dividend driven by its an annual hurdle rate of 7% on equity before paying incentive fees to management.

The company recently reduced its borrowing rates and is positioning the balance sheet to support higher leverage and hopefully returns to shareholders.

However, given the recent increase in non-accruals, I will likely be waiting until after the company reports calendar Q3 2018 earnings (est. November 1, 2018) before making additional purchases.

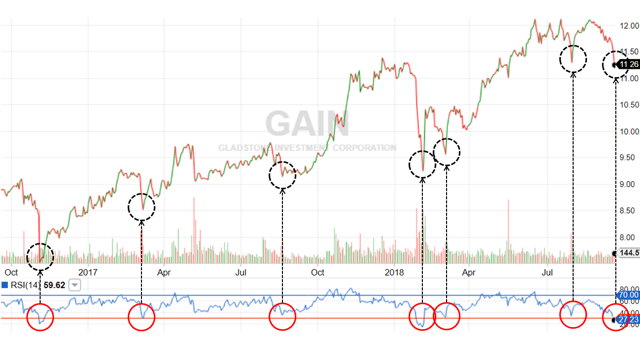

GAIN’s relative strength index (“RSI”) has dipped under 30 today (currently 27) indicating potentially oversold conditions and historically a buying point as shown in the following chart: