The following information was previously provided to subscribers of Premium BDC Reports along with:

- GAIN target prices/buying points

- GAIN risk profile, potential credit issues, and overall rankings

- GAIN dividend coverage projections (base, best, worst-case scenarios)

GAIN Summary

- GAIN currently has among the lowest leverage in the sector (net debt-to-equity 0.58) but management is growing the portfolio including the recent infrastructure-related acquisition of Utah Pacific Bridge & Steel.

- GAIN has the best NAV growth record of 28.7% (last 5 years) and there is a very good chance of another dividend increase for the reasons discussed in this report.

- GAIN is not expected to cover its Q3 monthly dividends with NII due to being underleveraged but management is actively growing the portfolio with plenty of realized gains for additional coverage.

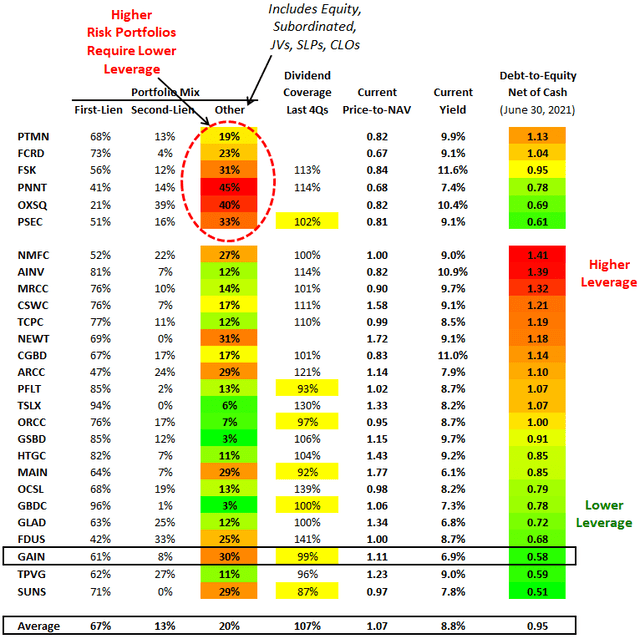

BDC Leverage Versus Portfolio Mix

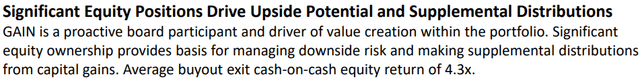

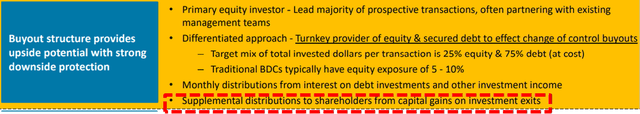

The following table shows each BDC ranked by its debt-to-equity ratio net of cash along with its portfolio mix. The “Other” column includes everything that is NOT first or second-lien secured debt. GAIN, CSWC, MAIN, and FDUS prefer to have a higher portion of their portfolio invested in equity positions providing them with realized gains and dividend income to support supplemental dividends.

BDCs with higher quality portfolios can support higher leverage and companies with lower leverage typically have lower dividend coverage (last four quarters) including GAIN, SUNS, GBDC, MAIN, and ORCC. I am expecting improved dividend coverage for many BDCs as leverage increases as well as higher amounts of first-lien positions (to support higher leverage).

- GAIN’s management has guided for portfolio growth given its extremely low leverage with a current debt-to-equity of 0.64 (0.58 net of cash) which is currently among the lowest in the BDC sector.

GAIN Realized Gains & Dividend Coverage Update

GAIN is considered a ‘Level 1’ dividend coverage BDC implying that there is a very good chance that the company will increase its dividends paid to shareholders due to plenty of capacity to grow the portfolio, lower non-accruals and NAV increases, additional dividend income from equity investments, maintaining a higher portfolio yield, and continued realized gains all of which are discussed in this update. Previously, GAIN had around $11.3 million or $0.34 per share of undistributed income “available for distribution at any one point”:

From previous call: “That is available for distribution at any one point. And we ended last year with a good amount of – the last fiscal year with a good amount of spillover as well. So that obviously started the year off with some cushion. As you know, this amount is already reduced by the book accrual of the GAAP capital gains-based incentive fee, and is not contractually due. We really manage our earnings on an annual basis. So we try to match the annual income to the annual dividend and that’s how we operate.”

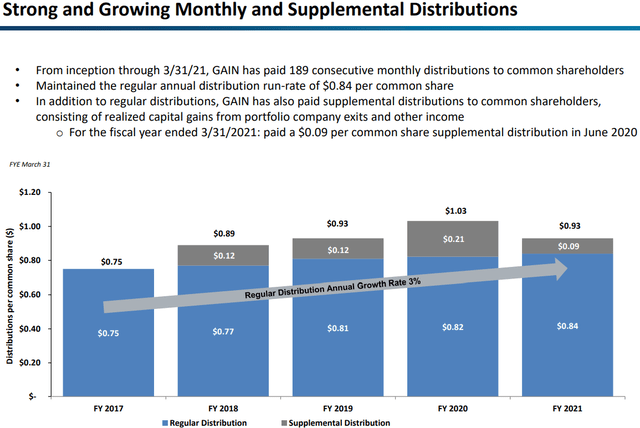

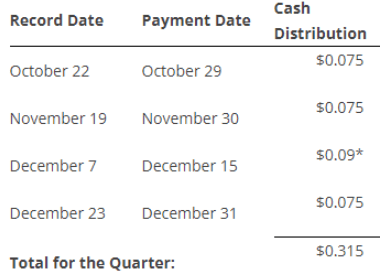

As predicted earlier this month in “GAIN Deep Dive Projections: Upcoming Dividend Announcement”, GAIN announced a supplemental dividend of $0.09 per share for Q4 2021 which was higher than my conservative estimate of $0.03 per share. More importantly, the company increased its monthly dividend by 7% (from $0.070 to $0.75).

“GAIN announced that its Board declared the following monthly cash distributions to common stockholders, increasing monthly distributions from $0.07 to $0.075 per share, or approximately 7%. The Company also announced its plan to report earnings for its second fiscal quarter ended September 30, 2021. The Company will also pay a supplemental distribution of $0.09 per share to holders of its common stock in December 2021. The board of directors will continue to evaluate the amount and timing of any additional, semi-annual or incremental, supplemental distributions in future periods.

There is a good chance that GAIN will report closer to its ‘best case’ projections including increased portfolio growth and leverage (driving the increased regular dividend) as well as rotation out of equity positions with realized gains driving the larger supplemental dividend. As mentioned in the report, I was waiting for the company to report results before upgrading to ‘Level 1’ and ‘Tier 1’ but given the recent announcement (and my faith in management to do the right thing) I have already upgraded GAIN in the BDC Google Sheets.

Over the last three years, GAIN has increased its dividend three times and while paying supplemental dividends and growing its NAV per share by 9.4%. Also, GAIN has relatively low amounts of leverage with the potential for improved coverage through portfolio growth and rotating out of equity investments.

“The good news is that we are seeing more activity, meaning more companies that are looking to be sold that we have an opportunity to look at. It’s really more a question of how rapidly we can add to our assets and continue to increase the income and thereby obviously slightly increase our monthly dividend payout. So that’s really our target, our goal. But it’s what we do every day.”

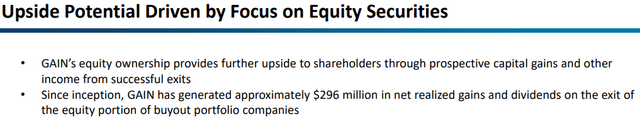

Most dividend coverage measures for BDCs use net investment income (“NII”) which is basically a measure of earnings. However, some BDCs achieve incremental returns with equity investments that are sold for realized gains often used to pay supplemental/special dividends. These BDCs include GAIN, FDUS, CSWC, TSLX, PNNT, TPVG, HTGC, and MAIN.

“Consistent with our policy, our Board will continue to evaluate any supplemental distributions which we can make and may make from capital gains. When we started the semiannual dividends distributions, which are a function of realized capital gains as we’ve stressed, we’ve been able to maintain it pretty effectively. We made the one in June as we move forward during the year in part as a function of liquidity ourselves being that we’re doing new deals also.”

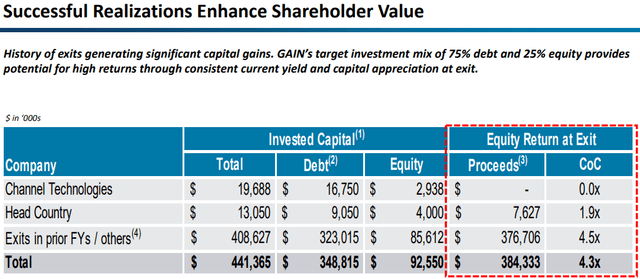

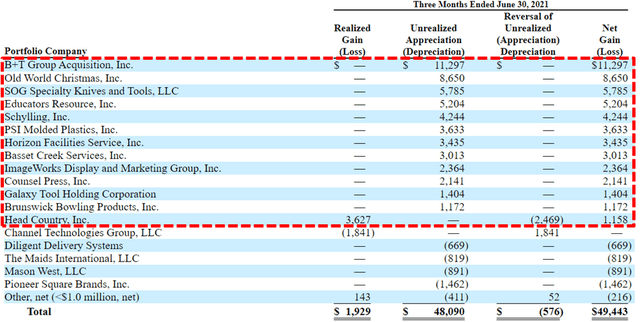

In June 2021, GAIN sold its investment in Head Country, Inc. and received cash proceeds of $16.7 million, including the repayment of its debt investment of $9.1 million at par which resulted in a success fee income of $2.0 million and a realized gain of $3.6 million or $0.11 per share that can be used to support additional supplemental dividends.

“With the sale of Head Country and from inception in 2005, Gladstone Investment has exited over 20 of its management supported buy-outs, generating significant net realized gains on these investments. Investments like Head Country prove out our focus on buying high quality businesses, backing outstanding management teams and our ability to be patient through longer hold periods.”

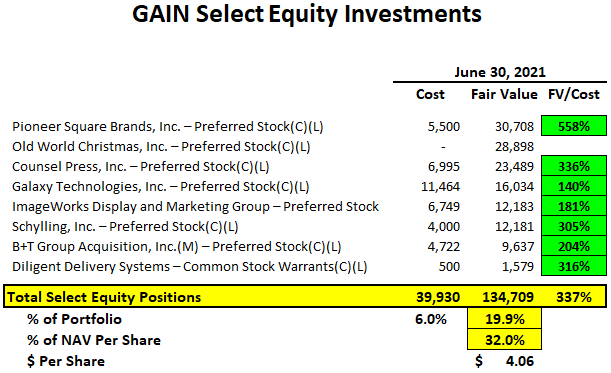

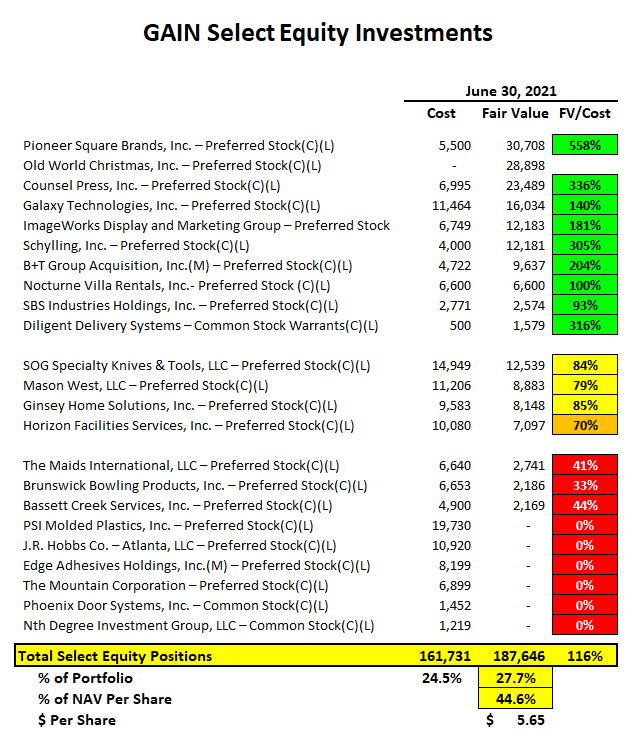

As shown in the following table, GAIN has significant unrealized gains in many of its preferred stock positions that will likely continue to drive additional realized gains over the coming quarters to support larger supplemental dividends in 2022. If GAIN exited these investments at their current fair value it would result in almost $95 million or $2.85 of realized gains. However, there are other investments valued below cost (please see the Risk Profile section) and management is taking a careful approach to exiting these investments:

“When and if they believe the time is right to exit for a variety of reasons, we will take that seriously. As we have pointed out we have had exits, as we go forward we will certainly be faced with opportunities for exits. And we’ll do that on a very careful basis, because, frankly, again, we exit a really good company and then we just have to figure out how we’re going to get a new opportunity to so to speak to replace it, right. Because, as you know, we keep focus very much on the income that we generate, because we want to keep growing our dividend our distributions to shareholders. So the debt pieces are really important. So again, yes, we will certainly entertain opportunities to exit if it really makes sense. And we might see some of that over the next six to nine months. But we’re not just going to rush out there and just do it just for the sake of doing it very frankly. We want to keep balance, and I think we’ve done a good job of that.”

During calendar Q4 2020, GAIN had $9.1 million or $0.27 per share of net realized gains which easily covers the upcoming monthly dividends of $0.07 per share.

The company will likely not fully cover its monthly dividends with net investment income for the quarter ended September 30, 2021, due to being underleveraged. Also, GAIN has lumpy dividend coverage partially due to its volatile dividend and other income and the company typically manages its dividend policy on an annual basis:

“Now just keep in mind that this other income we refer to can vary and probably will vary quarter-to-quarter. But we look at it and we try to manage this on an annualized basis. And we hopefully should be able to see some opportunity to continue generating this other income category during our calendar year 2021.”

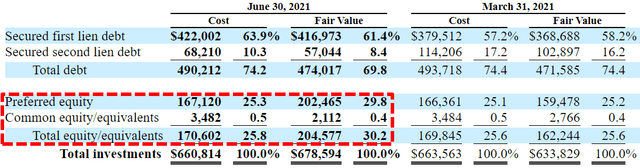

The amount of preferred/common equity increased from 25.6% to 30.2% of the portfolio fair value due to additional markups and needs to be partiallymonetized and eventually reinvested into income-producing secured debt.

I am expecting additional portfolio growth through increased leverage over the coming quarters including an additional first-lien debt investment in Nocturne Villa Rentals in July 2021 and a $24.3 million investment in Utah Pacific Bridge & Steel through a combination of secured first-lien debt and preferred equity. Utah Pacific is a manufacturer of large steel components used in bridge replacement, rehabilitation, and construction.

“Subsequent to 6/30/21, we financed the add-on of another operating company to our recent bio platform investment, which is called Nocturne Villas, and we close on a new buyout investment, which is called Utah Pacific Bridge & Steel. This company actually provides large steel components in bridge replacement, rehabilitation and construction, so somewhat playing into the whole infrastructure developments that will occur in this country. Those are really good companies and evaluations that work for our model. So we’ll make a couple new acquisitions yet over the next year or so. But we’re not going to rush out and just go crazy because multiples are just really pretty, pretty bizarre to be perfectly honest with you on companies that we see.”

Q. “On Utah Pacific that really seems to fit your business model quite well, and now in an industry that is getting a lot of attention. Can you give us a sense of what sort of terms you paid on that in terms of leverage, and maybe the interest rate?”

A. “When we buy a business, roughly 30% of the dollars that we put out are going to be in the equity component, and the balance is going to be in the debt component. Generally, again, as we publish our yield on the debt component of our portfolio is generally in the solid 12% range. We generally try to stay in and companies we’re looking at, we need to stick within kind of the six to maybe seven, seven and a half times EBITDA, and so as long as we’re kind of in that range, it works well for our model. This particular companies has a very strong ownership, owned by an individual really built the business and that fortunately, we’ve been able to have them stay involved with us. So we got really strong management, good team going forward. And it’s kind of deal that other people might have overlooked very frankly, and that’s where we worked a little bit harder to find those kind of transactions. Yeah, we’re very excited about this one, given their position that they have in their market area.”

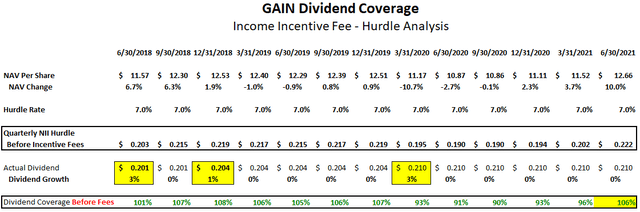

As leverage increases the company will likely earn around $0.22 per share each quarter covering 106% of the current dividend which is basically ‘math’ driven by an annual hurdle rate of 7% on equity before paying management incentive fees. It is important to note that the company could earn less than $0.22 per share but management will not be paid incentive fees as shown in the previous projections.

“The income-based incentive fee rewards the Adviser if our quarterly net investment income (before giving effect to any incentive fee) exceeds 1.75% [quarterly] of our net assets, adjusted appropriately for any share issuances or repurchases during the period (the “Hurdle Rate”). No incentive fee in any calendar quarter in which our pre-incentive fee net investment income does not exceed the Hurdle Rate (7.0% annualized)”

During calendar Q2 2021, the company did not sell any additional common shares under its ATM program. Similar to all BDCs, GAIN continues to reduce its overall borrowing rates and is taken into account with the updated projections:

- On August 11, 2021, GAIN priced its $117.0 million of 4.875% Notes due November 1, 2028, (GAINZ) and used the proceeds to fully redeem its 6.375% Series E Cumulative Term Preferred Stock due 2025 (GAINL).

- On February 24, 2021, GAIN priced its $112.5 million of 5.00% Notes due May 1, 2026, (GAINN) and used the proceeds to fully redeem its 6.25% Series D Cumulative Term Preferred Stock due 2023 (GAINM).

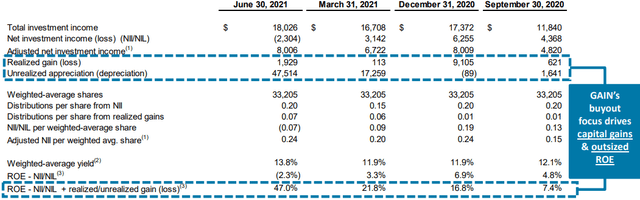

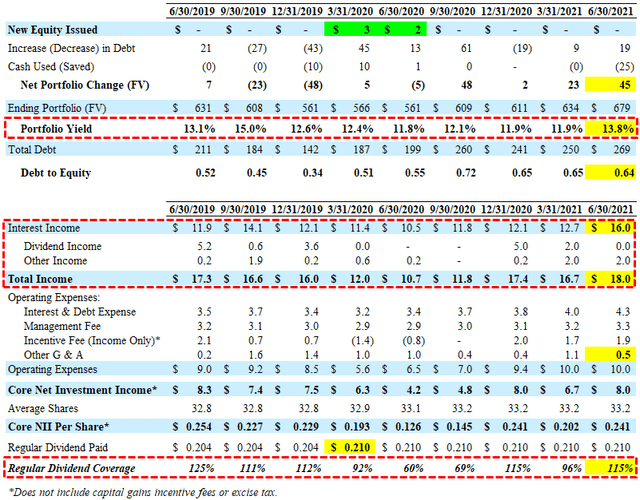

For calendar Q2 2021, GAIN hit its best-case projections due to much higher-than-expected portfolio yield and growth driving interest income to its highest level at $16.0 million compared to $12.7 million the previous quarter. However, a large portion of the increase was from the payments of past-due interest from portfolio companies previously on non-accrual status which has been taken into account with the updated projections.

“Investment income increased quarter-over-quarter, as interest income was lifted by the collection of past due interest from those loans that were previously on nonaccrual, and other income benefits from the close up transactions and related other income in the current quarter.”

Q. “On reported yields in the quarter, they were really strong up nearly 200 basis points quarter-on-quarter. Was there any one-time items in that? And can you give us a sense for your outlook going forward there?”

A. “That was related to my earlier comment on the loans returning to nonaccrual. So as you often see in periods where loans come back on accrual, they’ve made some catch-up payments, and that’s what particularly lifted yield this quarter.”

Q. “Could you give us a sense of how much interest you recognized back past due interest you recognized on B&T and Horizon? And did you reverse anything for SPS?”

A. “We did not reverse anything for SPS, so that was solely within this quarter. And then the amount that was collected in past dues this period was roughly $2 million.”

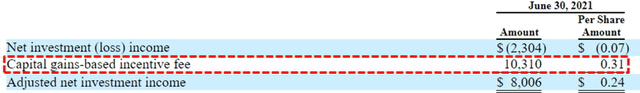

Also, there was a $2.0 million decrease in dividend and success fee income, the timing of which can be variable. ‘Core NII’ takes into account incentive fees related to capital gains.

“We ended the first quarter fiscal year ‘22 with adjusted NII of $0.24 per share, which is continuing improving trend started over the last two quarters of fiscal year ‘21, where we reported adjusted NII per share at $0.20 and $0.24, respectively. So we’re very pleased again with this positive trend, hopefully continuing forward.”

GAIN Risk Profile Quick Update

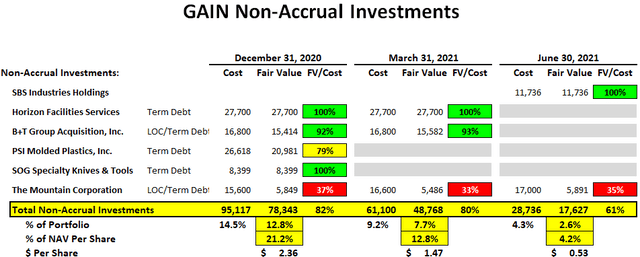

As predicted/discussed in the previous report, there was a meaningful improvement in the portfolio credit quality including reduced non-accruals as Horizon Facilities Services and B+T Group Acquisition, Inc. were added back to accrual. However, SBS Industries Holdings was added to non-accrual status during the quarter but remains valued at 100% similar to Horizon Facilities Services from previous quarters with a full recovery. Management is expecting SBS to be added back to accrual status “pretty quickly” and was discussed on the recent call:

“While, we added one loan to nonaccrual this quarter, which we believe will be at a relatively short-term change. Over the last two quarters, we returned four portfolio companies to accrual status. So with all that said, as of 6/30, only two of our portfolio companies were nonaccrual status.”

“The one that did go on nonaccrual it’s in a position to pay. But again, because of just some constraints regarding senior bank, we just had to put it on nonaccrual, but it will probably come back on accrual pretty quickly. So generally, I feel pretty good about where we are with all of those, again, somewhat temporarily. But now we feel really good about going forward.”

Also, The Mountain Corporation remains on non-accrual status. The fair value of non-accruals decreased to $17.6 million accounting for 2.6% of the portfolio at fair value (previously 7.7%).

From previous call: “We are seeing two of our portfolio companies that were on non-accrual come back on accrual status this quarter and hope to continue that trend during the next fiscal year with at least two other companies. We believe we can expect further improvement going into this new fiscal year for us. One, generally, things that we have been, as you know, work on with our portfolio companies, whether that’s a change in management or improved management or that sort of thing, I’d say, it’s a combination, frankly. Generally, their business were improving, but they also were doing a good job managing the companies. And as we said in there, hopefully, there are a couple more. And if that all happens here by the end of this calendar year, we pretty much could be out of all our non-accruals with maybe exception of one company.”

GAIN’s NAV per share increased by another 10% (from $11.52 to $12.66) mostly due to markups during the quarter including many of its equity positions.

“Assets increased to $713 million from $644 million. This is in large part due to the continuing recovery of the values of our equity holdings, which do make up about 25% of our total portfolio at cost.”

Full BDC Reports

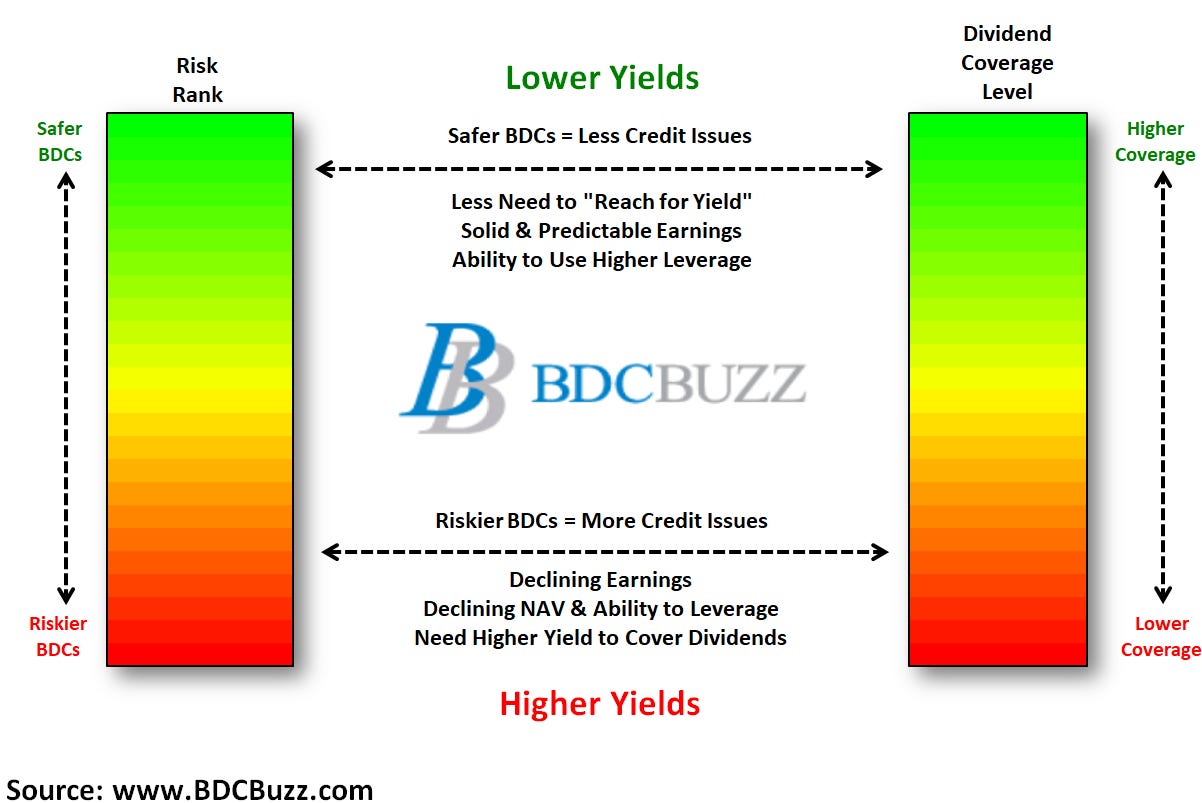

This information was previously made available to subscribers of Premium BDC Reports. BDCs trade within a wide range of multiples driving higher and lower yields mostly related to portfolio credit quality and dividend coverage potential (not necessarily historical coverage). This means investors need to do their due diligence before buying.