Summary

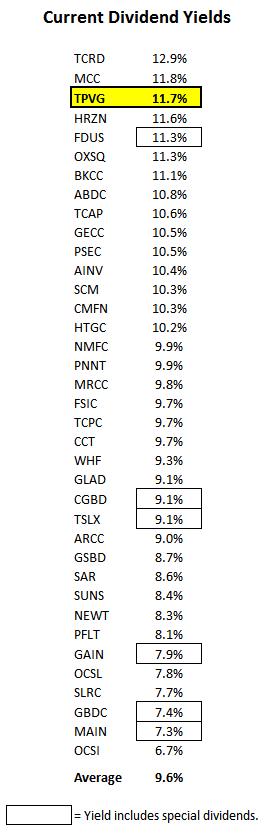

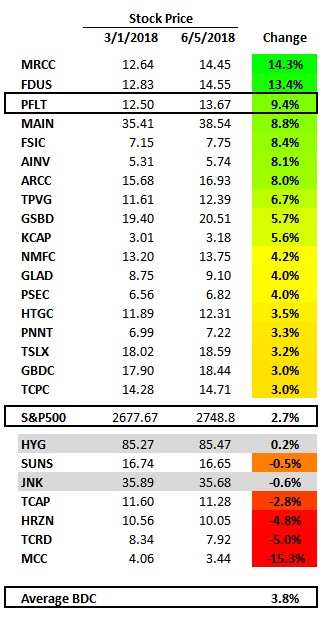

- BDCs will begin reporting calendar Q2 2018 results next and I will be focusing on potential issues including expected dividend cuts as discussed in this article.

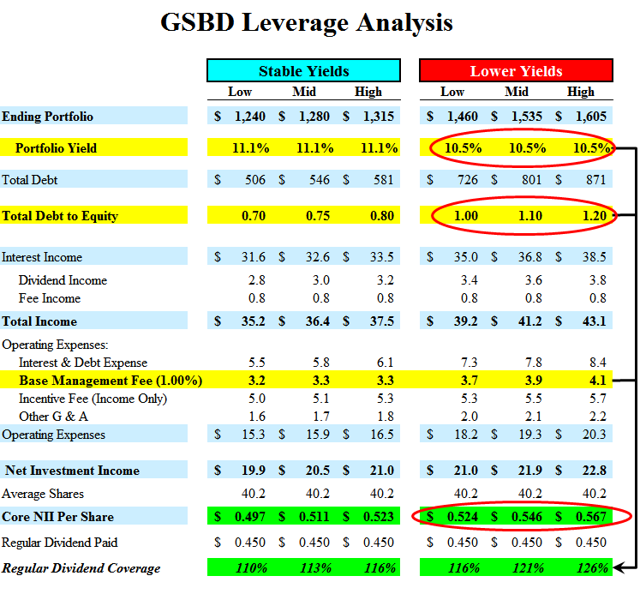

- I have correctly predicted many of the previous dividend cuts for the companies that I follow using my ‘Leverage Analysis & Dividend Potential’ as shown in this article.

- TCRD is working on many initiatives to improve dividend coverage including growing its Logan JV, rotating out of non-income producing assets and improving portfolio credit quality.

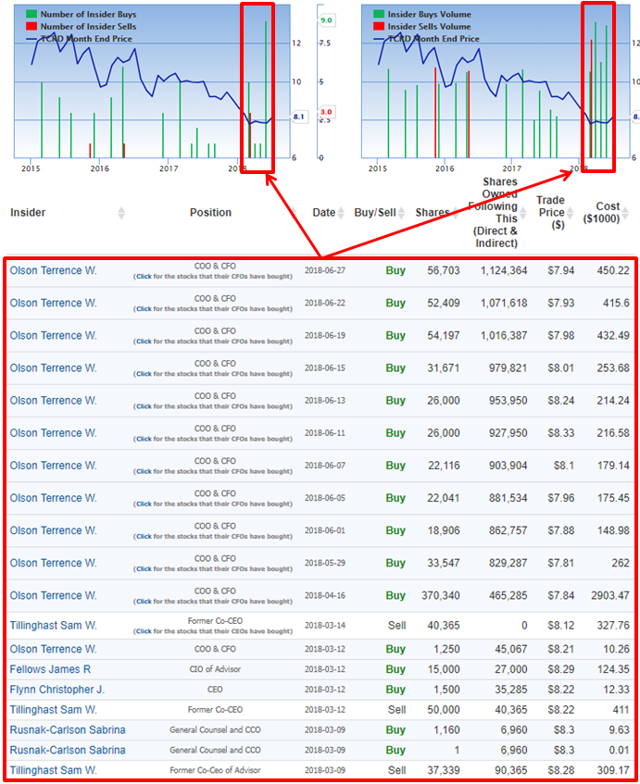

- TCRD insiders have recently been purchasing additional shares at prices between $7.81 and $8.33 compared to the current price of around $8.18.

- Investors need to pay close attention to upcoming results looking for potential credit issues and changes to expected dividend coverage.

You can read the full article at the following link:

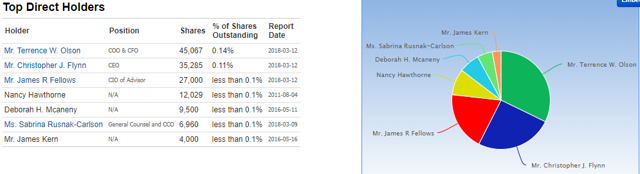

Recent TCRD Insider Purchases

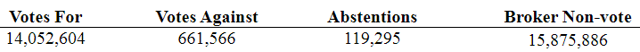

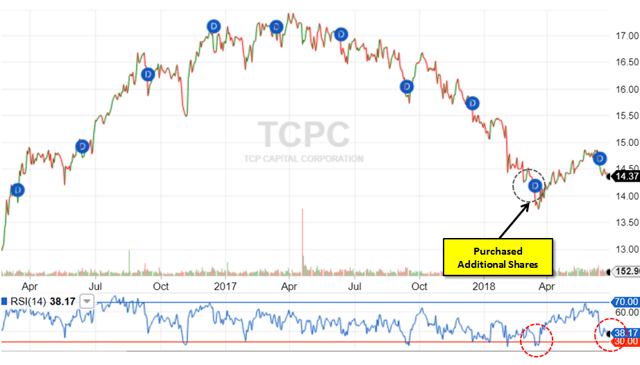

As shown below, THL Credit (TCRD) insiders have recently been purchasing additional shares at prices between $7.81 and $8.33 compared to the current price of around $8.18:

Source: GuruFocus

Upcoming Dividend Cut

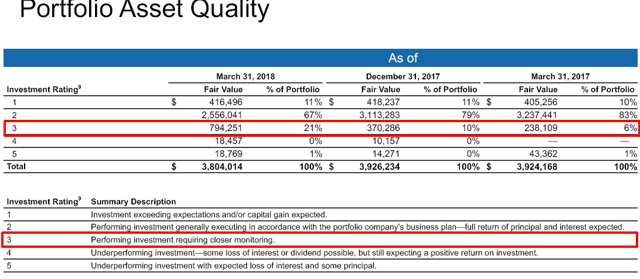

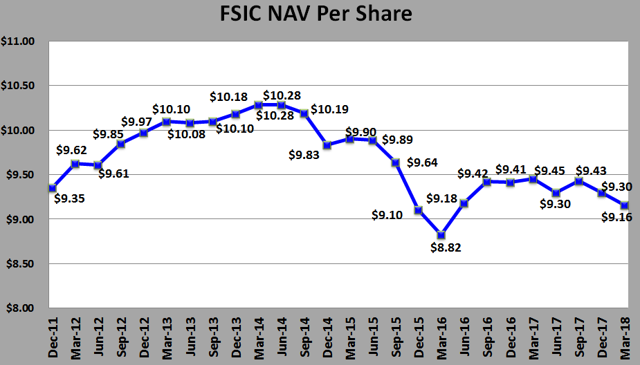

There is a good chance of a ~20% dividend reduction in late 2018 as the fee waivers expire as shown in the Leverage Analysis at the end of this article. Previously, I downgraded TCRD due to continued credit issues, declining net asset value (“NAV”) and portfolio yield as well as being above target leverage with expected declines in the overall size of the portfolio and investments restructured into non-income producing equity assets. However, the company is working to create value in those positions and eventually reinvest into income producing assets that should help to offset additional yield compression in the coming quarters.

“We are focused on improving the diversification across the portfolio, monetizing our non-income-producing equity securities and growing the Logan joint venture, which provided roughly a 14% ROE to our shareholders in the first quarter. While this strategy is being executed, we and our adviser have sought to ensure alignment among ourselves and our shareholders. As we’ve mentioned on our previous call, our adviser has agreed to waive all incentive fees for 2018.”

Source: TCRD Earnings Call Transcript

Management is waiving 100% of its incentive fees through 2018 and undistributed taxable remains around $0.34 per share and the board previously declared a dividend of $0.27 per share paid on June 29, 2018. It should be noted that the last time TCRD reduced its dividend, there was undistributed taxable income but management aligned the dividend closer to expected NII over the coming quarters.

Christopher Flynn, CEO: “We are focused on our stated strategy to invest in first lien loans of sponsor-backed companies and increase diversity across the portfolio, to monetize non-income producing equity securities, and to grow the Logan joint venture. We have continued to support our dividend over the course of this on-going transition and benefit from the strong support of our Advisor.”

Source: TCRD Earnings Call Transcript